20. Equity

About this

Report

Chairman's

Foreword

Corporate

Management Report Appendices Governance

Consolidated Financial Company Financial

Statements Statements

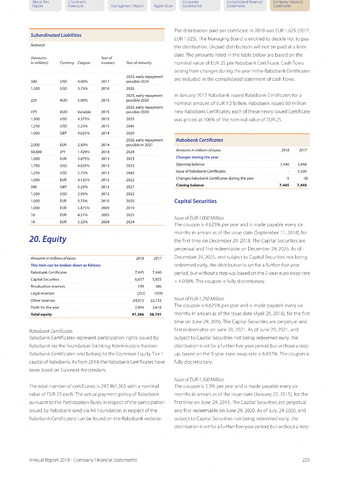

Subordinated Liabilities

Notional

(Amounts

in millions)

Currency

Coupon

Year of

issuance

Year of maturity

500

USD

4.00%

2017

2029, early repayment

possible 2024

1,500

USD

3.75%

2016

2026

225

AUD

5.00%

2015

2025, early repayment

possible 2020

475

AUD

Variable

2015

2025, early repayment

possible 2020

1,500

USD

4.375%

2015

2025

1,250

USD

5.25%

2015

2045

1,000

GBP

4.625%

2014

2029

2,000

EUR

2.50%

2014

2026, early repayment

possible in 2021

50,800

JPY

1.429%

2014

2024

1,000

EUR

3.875%

2013

2023

1,750

USD

4.625%

2013

2023

1,250

USD

5.75%

2013

2043

1,000

EUR

4.125%

2012

2022

500

GBP

5.25%

2012

2027

1,500

USD

3.95%

2012

2022

1,000

EUR

3.75%

2010

2020

1,000

EUR

5.875%

2009

2019

10

EUR

4.21%

2005

2025

10

EUR

5.32%

2004

2024

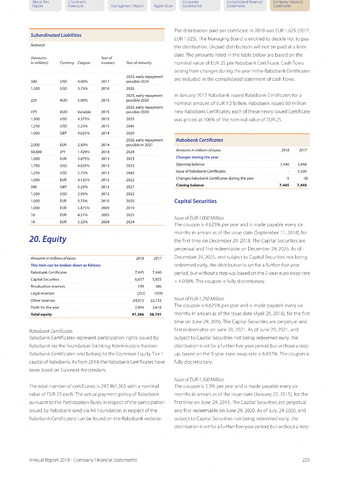

Amounts in millions of euros

2018

2017

This item can be broken down as follows:

Rabobank Certificates

7,445

7,440

Capital Securities

6,657

5,925

Revaluation reserves

199

386

Legal reserves

(252)

(359)

Other reserves

24,373

22,733

Profit for the year

2,944

2,616

Total equity

41,366

38,741

Rabobank Certificates

Rabobank Certificates represent participation rights issued by

Rabobank via the foundation Stichting Administratie Kantoor

Rabobank Certificaten and belong to the Common Equity Tier 1

capital of Rabobank. As from 2014, the Rabobank Certificates have

been listed on Euronext Amsterdam.

The total number of certificates is 297,961,365 with a nominal

value of EUR 25 each. The actual payment policy of Rabobank

pursuant to the Participation Rules in respect of the participation

issued by Rabobank (and via AK Foundation in respect of the

Rabobank Certificates) can be found on the Rabobank website.

The distribution paid per certificate in 2018 was EUR 1.625 (2017:

EUR 1.625). The Managing Board is entitled to decide not to pay

the distribution. Unpaid distributions will not be paid at a later

date. The amounts listed in the table below are based on the

nominal value of EUR 25 per Rabobank Certificate. Cash flows

arising from changes during the year in the Rabobank Certificates

are included in the consolidated statement of cash flows.

In January 2017 Rabobank issued Rabobank Certificates for a

nominal amount of EUR 1.5 billion. Rabobank issued 60 million

new Rabobank Certificates; each of these newly issued Certificate

was priced at 108% of the nominal value of EUR 25.

Rabobank Certificates

Amounts in millions of euros 2018 2017

Changes during the year:

Opening balance 7,440 5,948

Issue of Rabobank Certificates - 1,500

Changes Rabobank Certificates during the year 5 (8)

Closing balance 7,445 7,440

Capital Securities

Issue of EUR 1,000 Million

The coupon is 4.625% per year and is made payable every six

months in arrears as of the issue date (September 11,2018), for

the first time on December 29,2018. The Capital Securities are

perpetual and first redeemable on December 29,2025. As of

December 29,2025, and subject to Capital Securities not being

redeemed early, the distribution is set for a further five-year

period, but without a step-up, based on the 5-year euro swap rate

4.098%. The coupon is fully discretionary.

Issue of EUR 1,250 Million

The coupon is 6.625% per year and is made payable every six

months in arrears as of the issue date (April 26,2016), for the first

time on June 29, 2016. The Capital Securities are perpetual and

first redeemable on June 29, 2021As of June 29, 2021, and

subject to Capital Securities not being redeemed early, the

distribution is set for a further five-year period, but without a step-

up, based on the 5-year euro swap rate 6.697%. The coupon is

fully discretionary.

Issue of EUR 1,500 Million

The coupon is 5.5% per year and is made payable every six

months in arrears as of the issue date (January 22, 2015), for the

first time on June 29, 2015. The Capital Securities are perpetual

and first redeemable on June 29, 2020. As of July, 29 2020, and

subject to Capital Securities not being redeemed early, the

distribution is set for a further five-year period, but without a step-

Annual Report 2018 - Company Financial Statements

229