Notes to the Statement of Financial Position

4. Loans and Advances to Customers

1. Cash and Balances at Central

Banks

2. Short-term Government Papers

3. Loans and Advances to Credit

Institutions

-

5. Interest-Bearing Securities

About this

Report

Chairman's

Foreword

Corporate

Management Report Appendices Governance

Consolidated Financial Company Financial

Statements Statements

This item consists of legal tender, balances available on demand

with foreign central banks in countries where Rabobank

operates, as well as a balance with De Nederlandsche Bank (the

Dutch Central Bank)as required under its minimum reserve policy.

This item relates to government securities with an original term

to maturity of up to two years that the central bank in the country

of origin will redeem at a discount or accept as collateral. The

cost and market value of short-term government papers are

virtually the same.

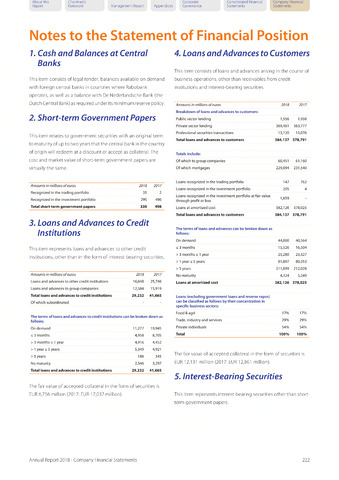

Amounts in millions of euros 2018 2017

Recognized in the trading portfolio 35 2

Recognized in the investment portfolio 295 496

Total short-term government papers 330 498

This item represents loans and advances to other credit

institutions, other than in the form of interest-bearing securities.

Amounts in millions of euros

Loans and advances to other credit institutions

Loans and advances to group companies

Total loans and advances to credit institutions

Of which subordinated

2018 2017

16,648 25,746

12,584 15,919

29,232 41,665

The terms of loans and advances to credit institutions can be broken down as

follows:

On demand 11,277 19,945

3 months 4,958 8,705

3 months 1 year 4,916 4,452

1 year 5 years 5,349 4,921

5 years 186 345

No maturity 2,546 3,297

Total loans and advances to credit institutions 29,232 41,665

The fair value of accepted collateral in the form of securities is

EUR 6,756 million (2017: EUR 17,037 million).

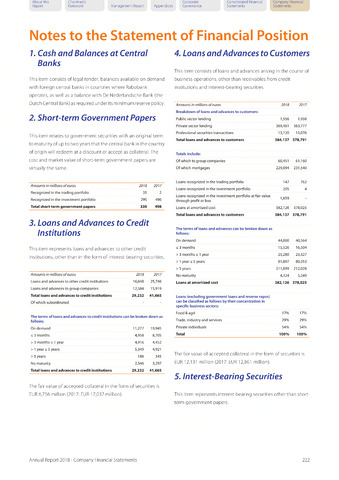

This item consists of loans and advances arising in the course of

business operations, other than receivables from credit

institutions and interest-bearing securities.

Amounts in millions of euros

2018

2017

Breakdown of loans and advances to customers:

Public sector lending

1,556

1,938

Private sector lending

369,461

363,777

Professional securities transactions

13,120

13,076

Total loans and advances to customers

384,137

378,791

Totals include:

Of which to group companies

60,451

61,160

Of which mortgages

229,094

231,540

Loans recognized in the trading portfolio

147

762

Loans recognized in the investment portfolio

205

4

Loans recognized in the investment portfolio at fair value

through profit or loss

1,659

Loans at amortized cost

382,126

378,025

Total loans and advances to customers

384,137

378,791

The terms of loans and advances can be broken down as

follows:

On demand

44,000

40,564

3 months

15,526

16,504

3 months 1 year

25,280

23,327

1 year 5 years

81,897

80,353

5 years

211,099

212,028

No maturity

4,324

5,249

Loans at amortized cost

382,126

378,025

Loans (excluding government loans and reverse repos)

can be classified as follows by their concentration in

specific business sectors:

Food agri

17%

17%

Trade, industry and services

29%

29%

Private individuals

54%

54%

Total

100%

100%

The fair value of accepted collateral in the form of securities is

EUR 12,131 million (2017: EUR 12,861 million).

This item represents interest-bearing securities other than short-

term government papers.

Annual Report 2018 - Company Financial Statements

222