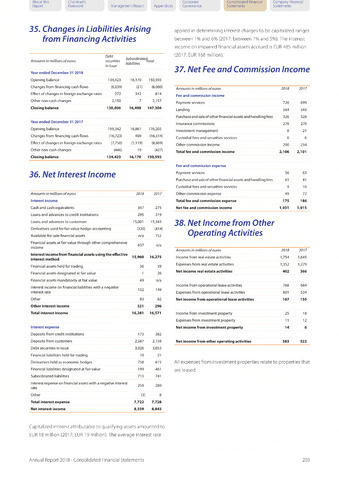

35. Changes in Liabilities Arising

from Financing Activities

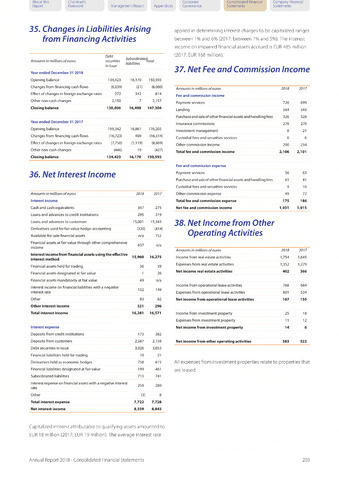

36. Net Interest Income

37. Net Fee and Commission Income

38. Net Income from Other

Operating Activities

About this

Report

Chairman's

Foreword

Corporate

Management Report Appendices Governance

Consolidated Financial Company Financial

Statements Statements

Debt

Amounts in millions of euros securities

in issue

Year ended December 31 2018

Opening balance 134,423

Changes from financing cash flows (6,039)

Effect of changes in foreign exchange rates 272

Other non-cash changes 2,150

Closing balance 130,806

Year ended December 31 2017

Opening balance 159,342

Changes from financing cash flows (16,723)

Effect of changes in foreign exchange rates (7,750)

Other non-cash changes (446)

Closing balance 134,423

Amounts in millions of euros

2018

2017

Interest income

Cash and cash equivalents

347

275

Loans and advances to credit institutions

295

319

Loans and advances to customers

15,001

15,343

Derivatives used for fair value hedge-accounting

(320)

(414)

Available-for-sale financial assets

n/a

752

Financial assets at fair value through other comprehensive

income

637

n/a

Interest incomefrom financial assets using the effective

interest method

15,960

16,275

Financial assets held for trading

36

39

Financial assets designated at fair value

1

26

Financial assets mandatorily at fair value

49

n/a

Interest income on financial liabilities with a negative

interest rate

152

149

Other

83

82

Other interest income

321

296

Total interest income

16,281

16,571

Interest expense

Deposits from credit institutions

173

382

Deposits from customers

2,587

2,158

Debt securities in issue

3,026

3,053

Financial liabilities held for trading

10

21

Derivatives held as economic hedges

758

615

Financial liabilities designated at fair value

199

461

Subordinated liabilities

713

741

Interest expense on financial assets with a negative interest

rate

259

289

Other

(3)

8

Total interest expense

7,722

7,728

Net interest income

8,559

8,843

Capitalized interest attributable to qualifying assets amounted to

EUR 18 million (2017: EUR 19 million). The average interest rate

applied in determining interest charges to be capitalized ranges

between 1% and 6% (2017: between 1% and 5%). The interest

income on impaired financial assets accrued is EUR 485 million

(2017: EUR 168 million).

Amounts in millions of euros

2018

2017

Fee and commission income

Payment services

726

699

Lending

564

543

Purchaseandsaleof other financial assets and handling fees

326

328

Insurance commissions

276

270

Investment management

8

21

Custodial fees and securities services

6

6

Other commission income

200

234

Total fee and commission income

2,106

2,101

Fee and commission expense

Payment services

56

63

Purchase and sale of other financial assets and handling fees

61

41

Custodial fees and securities services

9

10

Other commission expense

49

72

Total fee and commission expense

175

186

Net fee and commission income

1,931

1,915

Amounts in millions of euros 2018 2017

Income from real estate activities 1,754 1,645

Expenses from real estate activities 1,352 1,279

Net income real estate activities 402 366

Income from operational lease activities 768 684

Expenses from operational lease activities 601 534

Net income from operational lease activities 167 150

Income from investment property 25 18

Expenses from investment property 11 12

Net income from investment property 14 6

Net income from other operating activities 583 522

All expenses from investment properties relate to properties that

are leased.

Subordinated^.^!

liabilities

16,170

150,593

(21)

(6,060)

342

614

7

2,157

16,498

147,304

16,861

176,203

409

(16,314)

(1,119)

(8,869)

19

(427)

16,170

150,593

Annual Report 2018 - Consolidated Financial Statements

203