14. Investments in Associates and

Joint Ventures

-

-

14.7 Investments in Associates

74.2 Investments in Joint Ventures

About this

Report

Chairman's

Foreword

Corporate

Management Report Appendices Governance

Consolidated Financial Company Financial

Statements Statements

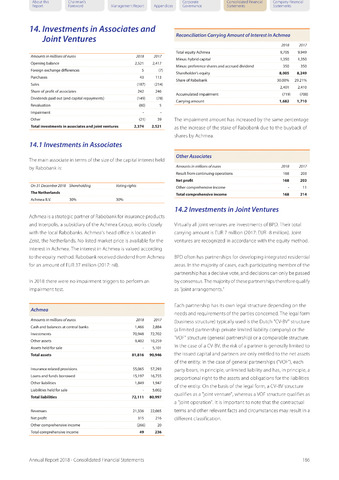

Amounts in millions of euros

2018

2017

Opening balance

2,521

2,417

Foreign exchange differences

5

(7)

Purchases

43

113

Sales

(187)

(214)

Share of profit of associates

242

246

Dividends paid out (and capital repayments)

(149)

(78)

Revaluation

(80)

5

Impairment

Other

(21)

39

Total investments in associates and joint ventures

2,374

2,521

The main associate in terms ofthe size of the capital interest held

by Rabobank is:

On 31 December 2018 Shareholding

The Netherlands

Achmea B.V. 30%

Voting rights

Achmea isa strategic partner of Rabobankfor insurance products

and Interpolis, a subsidiary ofthe Achmea Group, works closely

with the local Rabobanks. Achmea's head office is located in

Zeist, the Netherlands. No listed market price is available for the

interest in Achmea. The interest in Achmea is valued according

to the equity method. Rabobank received dividend from Achmea

for an amount of EUR 37 million (2017: nil).

In 2018 there were no impairment triggers to perform an

impairment test.

Reconciliation Carrying Amount of Interest in Achmea

Total equity Achmea

Minus: hybrid capital

Minus: preference shares and accrued dividend

Shareholder's equity

Share of Rabobank

Accumulated impairment

Carrying amount

2018

9,705

1,350

350

8,005

2017

9,949

1,350

350

8,249

30.00% 29.21%

2,401 2,410

(719)

1,682

(700)

1,710

The impairment amount has increased by the same percentage

as the increase ofthe stake of Rabobank due to the buyback of

shares by Achmea.

Other Associates

Amounts in millions of euros

Result from continuing operations

Net profit

Other comprehensive income

Total comprehensive income

2018 2017

168 203

168 203

11

168 214

Virtually all joint ventures are investments of BPD. Their total

carrying amount is EUR 7 million (2017: EUR -8 million). Joint

ventures are recognized in accordance with the equity method.

BPD often has partnerships for developing integrated residential

areas. In the majority of cases, each participating member ofthe

partnership has a decisive vote, and decisions can only be passed

by consensus.The majority ofthese partnerships therefore qualify

as "joint arrangements."

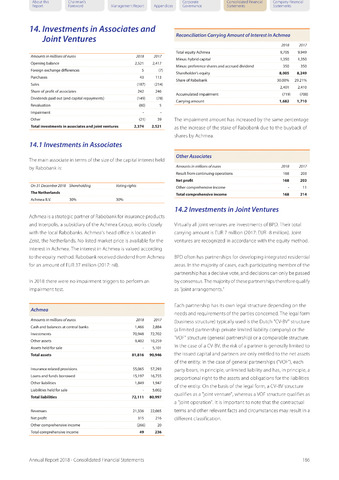

Achmea

Amounts in millions of euros

Cash and balances at central banks

Investments

Other assets

Assets held for sale

Total assets

Insurance related provisions

Loans and funds borrowed

Other liabilities

Liabilities held for sale

Total liabilities

Revenues

Net profit

Other comprehensive income

Total comprehensive income

2018

1,466

70,948

9,402

81,816

55,065

15,197

1,849

72,111

21,336

315

(266)

49

2017

2,884

72,702

10,259

5,101

90,946

57,293

16,755

1,947

5,002

80,997

22,065

216

20

236

Each partnership has its own legal structure depending on the

needs and requirements ofthe parties concerned. The legal form

(business structure) typically used is the Dutch "CV-BV" structure

(a limited partnership-private limited liability company) or the

"VOF" structure (general partnership) or a comparable structure.

In the case of a CV-BV, the risk of a partner is generally limited to

the issued capital and partners are only entitled to the net assets

ofthe entity. In the case of general partnerships ("VOF"), each

party bears, in principle, unlimited liability and has, in principle, a

proportional right to the assets and obligations for the liabilities

ofthe entity. On the basis ofthe legal form, a CV-BV structure

qualifies as a "joint venture", whereas a VOF structure qualifies as

a "joint operation". It is important to note that the contractual

terms and other relevant facts and circumstances may result in a

different classification.

Annual Report 2018 - Consolidated Financial Statements

186