13. Financial Assets at Fair Value

through Other Comprehensive

Income

About this

Report

Chairman's

Foreword

Management Report Appendices

Corporate

Governance

Consolidated Financial

Statements

Company Financial

Statements

13a Financial Assets at Fair Value through Other

Comprehensive Income

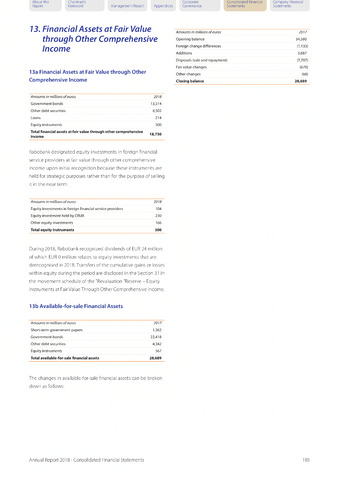

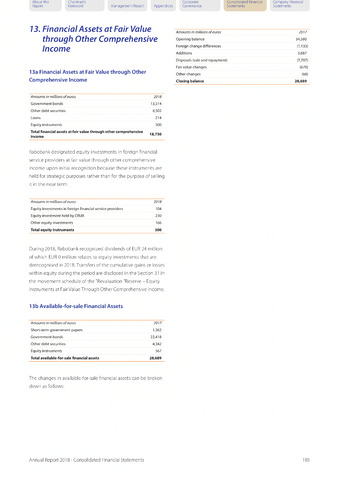

Amounts in millions of euros

2017

Opening balance

34,580

Foreign change differences

(1,133)

Additions

3,687

Disposals (sale and repayment)

(7,707)

Fair value changes

(670)

Other changes

(68)

Closing balance

28,689

Amounts in millions of euros

Government bonds

Other debt securities

Loans

Equity instruments

Total financial assets at fair value through other comprehensive

income

2018

13,514

4,502

214

500

18,730

Rabobank designated equity investments in foreign financial

service providers at fair value through other comprehensive

income upon initial recognition because these instruments are

held for strategic purposes rather than for the purpose of selling

it in the near term.

Amounts in millions of euros 2018

Equity investments in foreign financial service providers 104

Equity investment held by CRUA 230

Other equity investments 166

Total equity instruments 500

During 2018, Rabobank recognized dividends of EUR 24 million

of which EUR 0 million relates to equity investments that are

derecognised in 2018. Transfers of the cumulative gains or losses

within equity during the period are disclosed in the Section 31 in

the movement schedule of the "Revaluation "Reserve - Equity

Instruments at FairValueThrough OtherComprehensive Income.

13b Available-for-sale Financial Assets

Amounts in millions of euros 2017

Short-term government papers 1,362

Government bonds 22,418

Other debt securities 4,342

Equity instruments 567

Total available-for-sale financial assets 28,689

The changes in available-for-sale financial assets can be broken

down as follows:

Annual Report 2018 - Consolidated Financial Statements

185