-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

Contents Foreword Management report Corporate governance Consolidated Financial Statements Company Financial Statements Pillar 3

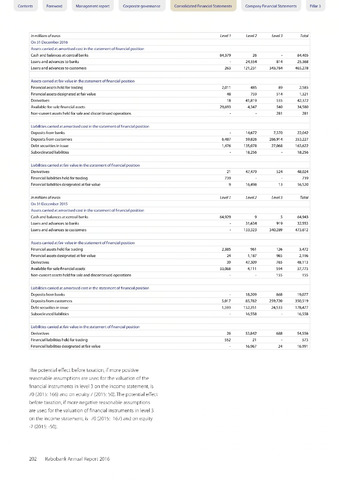

in millions of euros

Level 1

Level 2

Level 3

Total

On 31 December 2016

Assets carried at amortised cost in the statement of financial position

Cash and balances at central banks

84,379

26

84,405

Loans and advances to banks

24,554

814

25,368

Loans and advances to customers

263

121,231

343,784

465,278

Assets carried at fair value in the statement of financial position

Financial assets held for trading

2,011

485

89

2,585

Financial assets designated at fair value

48

759

514

1,321

Derivatives

18

41,819

535

42,372

Available-for-sale financial assets

29,693

4,347

540

34,580

Non-current assets held for sale and discontinued operations

281

281

Liabilities carried at amortised cost in the statement of financial position

Deposits from banks

14,672

7,370

22,042

Deposits from customers

6,487

59,826

286,914

353,227

Debt securities in issue

1,476

135,078

27,068

163,622

Subordinated liabilities

18,256

18,256

Liabilities carried at fair value in the statement of financial position

Derivatives

21

47,479

524

48,024

Financial liabilities held for trading

739

739

Financial liabilities designated at fair value

9

16,498

13

16,520

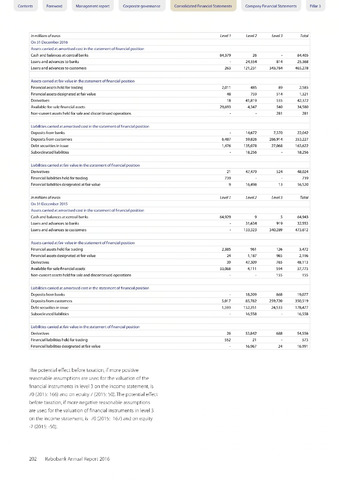

in millions of euros

Level 1

Level 2

Level 3

Total

On 31 December 2015

Assets carried at amortised cost in the statement of financial position

Cash and balances at central banks

64,929

9

5

64,943

Loans and advances to banks

31,634

919

32,553

Loans and advances to customers

133,323

340,289

473,612

Assets carried at fair value in the statement of financial position

Financial assets held for trading

2,385

961

126

3,472

Financial assets designated at fair value

24

1,187

985

2,196

Derivatives

39

47,309

765

48,113

Available-for-sale financial assets

33,068

4,111

594

37,773

Non-current assets held for sale and discontinued operations

155

155

Liabilities carried at amortised cost in the statement of financial position

Deposits from banks

18,209

868

19,077

Deposits from customers

5,017

85,782

259,720

350,519

Debt securities in issue

1,593

152,351

24,533

178,477

Subordinated liabilities

16,558

16,558

Liabilities carried at fair value in the statement of financial position

Derivatives

26

53,842

688

54,556

Financial liabilities held for trading

552

21

573

Financial liabilities designated at fair value

16,967

24

16,991

The potential effect before taxation, if more positive

reasonable assumptions are used for the valuation of the

financial instruments in level 3 on the income statement, is

70 (2015: 166) and on equity 7 (2015: 50). The potential effect

before taxation, if more negative reasonable assumptions

are used for the valuation of financial instruments in level 3

on the income statement, is -70 (2015: -167) and on equity

-7 (2015: -50).

202 Rabobank Annual Report 2016