Key figures

-

-

-

-

-

-

-

-

-

-

Contents Foreword Management report Corporate governance Consolidated Financial Statements Company Financial Statements Pillar 3

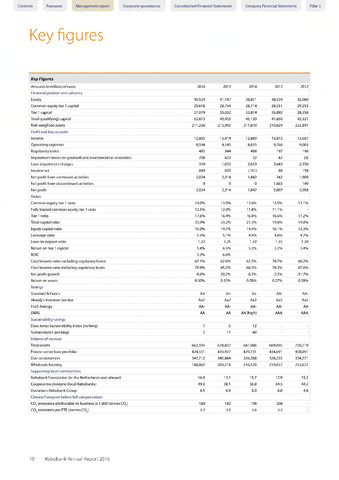

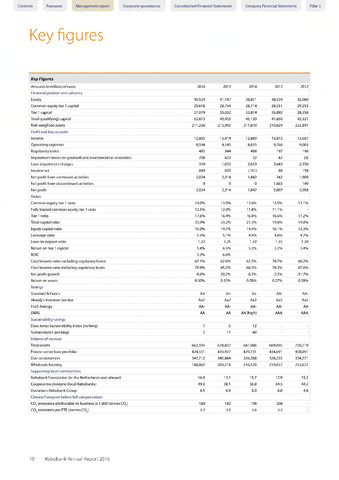

Key Figures

Amounts in millions of euros

2016

2015

2014

2013

2012

Financial position and solvency

Equity

40,524

41,197

38,871

38,534

42,080

Common equity tier 1 capital

29,618

28,754

28,714

28,551

29,253

Tier 1 capital

37,079

35,052

33,874

35,092

38,358

Total (qualifying) capital

52,873

49,455

45,139

41,650

42,321

Risk-weighted assets

211,226

213,092

211,870

210,829

222,847

Profit and loss account

Income

12,805

13,014

12,889

13,072

13,607

Operating expenses

8,594

8,145

8,055

9,760

9,003

Regulatory levies

483

344

488

197

196

Impairment losses on goodwill and investments in associates

700

623

32

42

(9)

Loan impairment charges

310

1,033

2,633

2,643

2,350

Income tax

694

655

(161)

88

158

Net profit from continued activities

2,024

2,214

1,842

342

1,909

Net profit from discontinued activities

0

0

0

1,665

149

Net profit

2,024

2,214

1,842

2,007

2,058

Ratios

Common equity tier 1 ratio

14.0%

13.5%

13.6%

13.5%

13.1%

Fully loaded common equity tier 1 ratio

13.5%

12.0%

11.8%

11.1%

Tier 1 ratio

17.6%

16.4%

16.0%

16.6%

17.2%

Total capital ratio

25.0%

23.2%

21.3%

19.8%

19.0%

Equity capital ratio

15.0%

14.7%

14.4%

16.1%

15.3%

Leverage ratio

5.5%

5.1%

4.9%

4.8%

4.7%

Loan-to-deposit ratio

1.22

1.25

1.32

1.35

1.39

Return on tier 1 capital

5.8%

6.5%

5.2%

5.2%

5.4%

ROIC

5.2%

6.0%

Cost/income ratio excluding regulatory levies

67.1%

62.6%

62.5%

74.7%

66.2%

Cost/income ratio including regulatory levies

70.9%

65.2%

66.3%

76.2%

67.6%

Net profit growth

-8.6%

20.2%

-8.2%

-2.5%

-21.7%

Return on assets

0.30%

0.33%

0.28%

0.27%

0.28%

Ratings

Standard Poor's

A+

A+

A+

AA-

AA-

Moody's Investors Service

Aa2

Aa2

Aa2

Aa2

Aa2

Fitch Ratings

AA-

AA-

AA-

AA-

AA

DBRS

AA

AA

AA (high)

AAA

AAA

Sustainability ratings

Dow Jones Sustainability Index (ranking)

7

5

12

Sustainalytics (ranking)

2

11

40

Volume of services

Total assets

662,593

678,827

681,086

669,095

750,710

Private sector loan portfolio

424,551

433,927

429,731

434,691

458,091

Due to customers

347,712

345,884

326,288

326,222

334,271

Wholesale funding

188,862

203,218

216,529

219,057

253,672

Supporting local communities

Rabobank Foundation (in the Netherlands and abroad)

16.9

13.1

15.7

12.9

15.2

Cooperative dividend (local Rabobanks)

49.0

38.1

36.8

44.5

44.2

Donations Rabobank Group

6.5

6.9

8.0

8.0

4.6

Climate Footprint before full compensation

CO2 emissions attributable to business (x 1,000 tonnes CO2)

180

182

198

208

CO2 emissions per FTE (tonnes CO2)

3.7

3.5

3.6

3.5

10 Rabobank Annual Report 2016