-

-

4 Risk exposure on financial instruments

Contents Management report Corporate governance Consolidated financial statements Financial statements Pillar 3

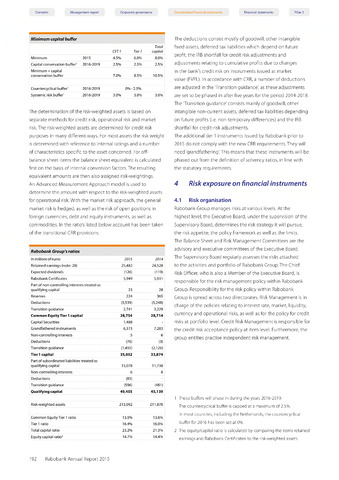

Minimum capital buffer

CET1

Tier 7

Total

capital

Minimum

2015

4.5%

6.0%

8.0%

Capital conservation buffer1

2016-2019

2.5%

2.5%

2.5%

Minimum capital

conservation buffer

7.0%

8.5%

10.5%

Countercyclical buffer1

2016-2019

0

i% - 2.5%

Systemic risk buffer1

2016-2019

3.0%

3.0%

3.0%

The determination of the risk-weighted assets is based on

separate methods for credit risk, operational risk and market

risk.The risk-weighted assets are determined for credit risk

purposes in many different ways. For most assets the risk weight

is determined with reference to internal ratings and a number

of characteristics specific to the asset concerned. For off-

balance sheet items the balance sheet equivalent is calculated

first on the basis of internal conversion factors. The resulting

equivalent amounts are then also assigned risk-weightings.

An Advanced Measurement Approach model is used to

determine the amount with respect to the risk-weighted assets

for operational risk. With the market risk approach, the general

market risk is hedged, as well as the risk of open positions in

foreign currencies, debt and equity instruments, as well as

commodities. In the ratio's listed below account has been taken

of the transitional CRR provisions.

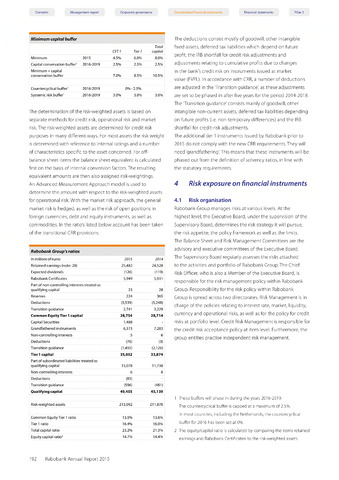

Rabobank Group's ratios

in millions of euros

2015

2014

Retained earnings (note: 28)

25,482

24,528

Expected dividends

(126)

(119)

Raboban k Certificates

5,949

5,931

Part of non-controlling interests treated as

qualifying capital

23

28

Reserves

224

365

Deductions

(5,539)

(5,248)

Transition guidance

2,741

3,229

Common Equity Tier 1 capital

28,754

28,714

Capital Securities

1,488

Grandfathered instruments

6,373

7,283

Non-controlling interests

5

6

Deductions

(76)

(3)

Transition guidance

(1,492)

(2,126)

Tier 1 capital

35,052

33,874

Part of subordinated liabilities treated as

qualifying capital

15,078

11,738

Non-controlling interests

6

8

Deductions

(85)

Transition guidance

(596)

(481)

Qualifying capital

49,455

45,139

Risk-weighted assets

213,092

211,870

Common Equity Tier 1 ratio

13.5%

13.6%

Tier 1 ratio

16.4%

16.0%

Total capital ratio

23.2%

21.3%

Equity capital ratio2

14.7%

14.4%

The deductions consist mostly of goodwill, other intangible

fixed assets, deferred tax liabilities which depend on future

profit, the IRB shortfall for credit risk adjustments and

adjustments relating to cumulative profits due to changes

in the bank's credit risk on instruments issued at market

value (FVPL). In accordance with CRR, a number of deductions

are adjusted in the 'Transition guidance', as these adjustments

are set to be phased in after five years for the period 2014-2018.

The 'Transition guidance' consists mainly of goodwill, other

intangible non-current assets, deferred tax liabilities depending

on future profits (i.e. non-temporary differences) and the IRB

shortfall for credit-risk adjustments.

The additional tier 1 instruments issued by Rabobank prior to

2015 do not comply with the new CRR requirements.They will

need 'grandfathering'.This means that these instruments will be

phased out from the definition of solvency ratios, in line with

the statutory requirements.

4.1 Risk organisation

Rabobank Group manages risks at various levels. At the

highest level, the Executive Board, under the supervision of the

Supervisory Board, determines the risk strategy it will pursue,

the risk appetite, the policy framework as well as the limits.

The Balance Sheet and Risk Management Committees are the

advisory and executive committees of the Executive Board.

The Supervisory Board regularly assesses the risks attached

to the activities and portfolio of Rabobank Group.The Chief

Risk Officer, who is also a Member of the Executive Board, is

responsible for the risk management policy within Rabobank

Group. Responsibility for the risk policy within Rabobank

Group is spread across two directorates. Risk Management is in

charge of the policies relating to interest rate, market, liquidity,

currency and operational risks, as well as for the policy for credit

risks at portfolio level. Credit Risk Management is responsible for

the credit risk acceptance policy at item level. Furthermore, the

group entities practise independent risk management.

1 These buffers will phase in during the years 2016-2019.

The countercyclical buffer is capped at a maximum of 2.5%.

In most countries, including the Netherlands, the countercyclical

buffer for 2016 has been set at 0%.

2 The equity/capital ratio is calculated by comparing the items retained

earnings and Rabobank Certificaten to the risk-weighted assets.

192 Rabobank Annual Report 2015