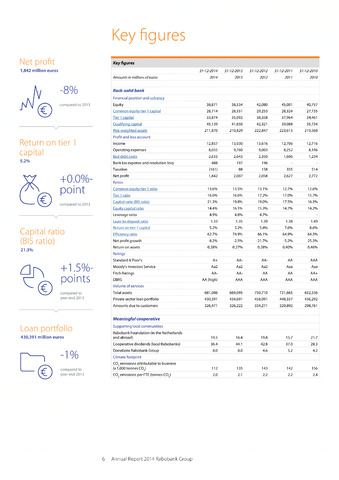

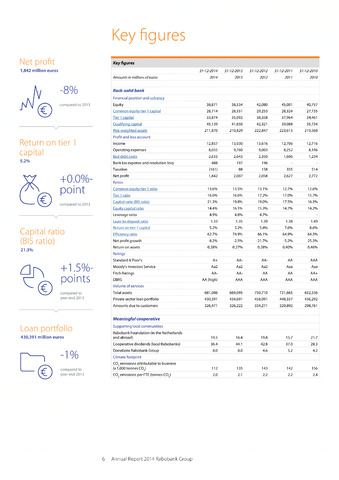

Key figures

-8%

+0.0%-

point

+1.5%-

1 points

-1%

V (2

Net profit

Return on tier 1

capital

Capital ratio

(BIS ratio)

Loan portfolio

-

-

-

-

1,842 million euros

compared to 2013

5.2%

compared to 2013

21.3%

compared to

year-end 2013

430,391 million euros

compared to

year-end 2013

Key figures

31-12-2014

31-12-2013

31-12-2012

31-12-2011

31-12-2010

Amounts in millions of euros

2014

2013

2012

2011

2010

Rock-solid bank

Financial position and solvency

Equity

38,871

38,534

42,080

45,001

40,757

Common equitv tier 1 capital

28,714

28,551

29,253

28,324

27,735

Tier 1 caoital

33,874

35,092

38,358

37,964

34,461

Oualifving capital

45,139

41,650

42,321

39,088

35,734

Risk-weiahted assets

211,870

210,829

222,847

223,613

219,568

Profit and loss account

Income

12,857

13,030

13,616

12,706

12,716

Operating expenses

8,055

9,760

9,003

8,252

8,196

Bad debt costs

2,633

2,643

2,350

1,606

1,234

Bank tax expense and resolution levy

488

197

196

Taxation

(161)

88

158

355

514

Net profit

1,842

2,007

2,058

2,627

2,772

Ratios

Common equitv tier 1 ratio

13.6%

13.5%

13.1%

12.7%

12.6%

Tier 1 ratio

16.0%

16.6%

17.2%

17.0%

15.7%

Caoital ratio (BIS ratio)

21.3%

19.8%

19.0%

17.5%

16.3%

Equitv capital ratio

14.4%

16.1%

15.3%

14.7%

14.2%

Leverage ratio

4.9%

4.8%

4.7%

Loan-to-deposit ratio

1.33

1.35

1.39

1.38

1.49

Return on tier 1 capital

5.2%

5.2%

5.4%

7.6%

8.6%

Efficiency ratio

62.7%

74.9%

66.1%

64.9%

64.5%

Net profit growth

-8.2%

-2.5%

-21.7%

-5.2%

25.5%

Return on assets

0.28%

0.27%

0.28%

0.40%

0.46%

Ratings

Standard Poor's

A+

AA-

AA-

AA

AAA

Moody's Investors Service

Aa2

Aa2

Aa2

Aaa

Aaa

Fitch Ratings

AA-

AA-

AA

AA

AA+

DBRS

AA (high)

AAA

AAA

AAA

AAA

Volume of services

Total assets

681,086

669,095

750,710

731,665

652,536

Private sector loan portfolio

430,391

434,691

458,091

448,337

436,292

Amounts due to customers

326,471

326,222

334,271

329,892

298,761

Meaningful cooperative

Supporting local communities

Rabobank Foundation (in the Netherlands

and abroad)

19.5

16.4

19.8

15.7

21.7

Cooperative dividends (local Rabobanks)

36.4

44.1

42.8

37.0

28.3

Donations Rabobank Group

8.0

8.0

4.6

5.2

4.2

Climate footprint

C02 emissions attributable to business

(x 1,000 tonnes C02)

112

135

143

142

156

C02 emissions per FTE (tonnes C02)

2.0

2.1

2.2

2.2

2.4

6 Annual Report 2014 Rabobank Group