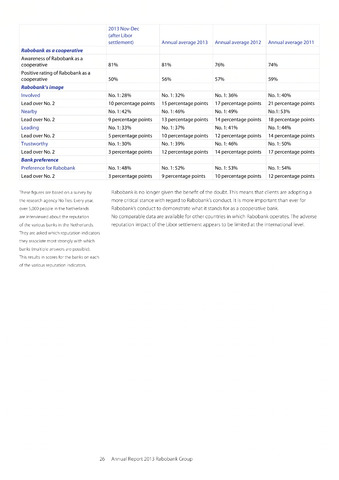

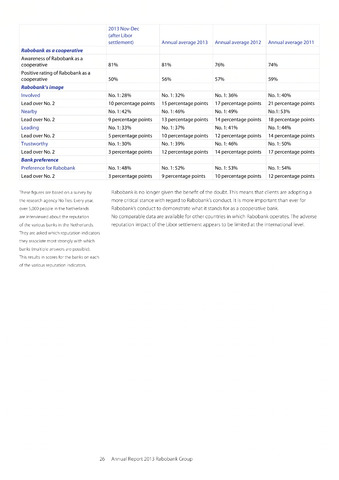

2013 Nov-Dec

(after Libor

settlement)

Annual average 2013

Annual average 2012

Annual average 2011

Rabobank as a cooperative

Awareness of Rabobank as a

cooperative

81%

81%

76%

74%

Positive rating of Rabobank as a

cooperative

50%

56%

57%

59%

Rabobank's image

Involved

No. 1:28%

No. 132%

No. 1:36%

No. 140%

Lead over No. 2

10 percentage points

15 percentage points

17 percentage points

21 percentage points

Nearby

No. 1:42%

No. 146%

No. 1:49%

No.153%

Lead over No. 2

9 percentage points

13 percentage points

14 percentage points

18 percentage points

Leading

No. 1:33%

No. 137%

No. 1:41%

No. 144%

Lead over No. 2

5 percentage points

10 percentage points

12 percentage points

14 percentage points

Trustworthy

No. 1:30%

No. 139%

No. 1:46%

No. 150%

Lead over No. 2

3 percentage points

12 percentage points

14 percentage points

17 percentage points

Bank preference

Preference for Rabobank

No. 1:48%

No. 152%

No. 1:53%

No. 154%

Lead over No. 2

3 percentage points

9 percentage points

10 percentage points

12 percentage points

These figures are based on a survey by

the research agency No Ties. Every year,

over 5,000 people in the Netherlands

are interviewed about the reputation

of the various banks in the Netherlands.

They are asked which reputation indicators

they associate most strongly with which

banks (multiple answers are possible).

This results in scores for the banks on each

of the various reputation indicators.

Rabobank is no longer given the benefit of the doubt. This means that clients are adopting a

more critical stance with regard to Rabobank's conduct. It is more important than ever for

Rabobank's conduct to demonstrate what it stands for as a cooperative bank.

No comparable data are available for other countries in which Rabobank operates. The adverse

reputation impact of the Libor settlement appears to be limited at the international level.

26 Annual Report 2013 Rabobank Group