The outlook for Rabobank Group

Bad debt costs at 59 basis points

Value adjustments at Rabobank Group came to EUR 2,643 (2,350) million in 2013, a marked

increase compared to 2012.There was a further increase in bad debt costs at Rabo Real Estate

Group due to the continuing poor state of the real estate market in the Netherlands. For the

local Rabobanks, commercial real estate, inland shipping and greenhouse horticulture also

suffered in 2013. In addition, the low level of domestic spending led to difficulties for sectors

focusing on the domestic retail market. Export-oriented companies were able to benefit from

the increase in world trade. The total value adjustments at the domestic retail banking division

were slightly above the high level seen in 2012. At Rabobank International, which has a more

internationally diversified portfolio, the level of value adjustments fell. At De Lage Landen, value

adjustments rose slightly. In relation to the average loan portfolio, the bad debt costs for

Rabobank Group came to 59 (52) basis points on an annualised basis. This is significantly higher

than the long-term average of 28 basis points.

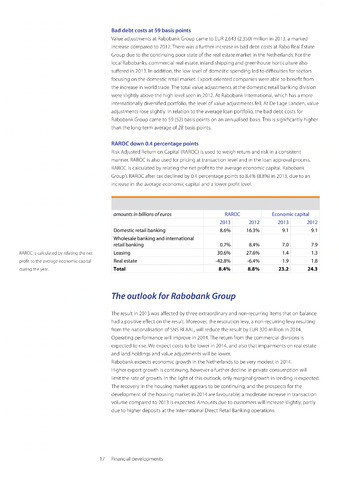

RAROC down 0.4 percentage points

Risk Adjusted Return on Capital (RAROC) is used to weigh return and risk in a consistent

manner. RAROC is also used for pricing at transaction level and in the loan approval process.

RAROC is calculated by relating the net profit to the average economic capital. Rabobank

Group's RAROC after tax declined by 0.4 percentage points to 8.4% (8.8%) in 2013, due to an

increase in the average economic capital and a lower profit level.

RAROC is calculated by relating the net

profit to the average economic capital

during the year.

amounts in billions of euros

RAROC

Economic capital

2013

2012

2013

2012

Domestic retail banking

8.6%

16.3%

9.1

9.1

Wholesale banking and international

retail banking

0.7%

8.4%

7.0

7.9

Leasing

30.6%

27.6%

1.4

1.3

Real estate

-42.8%

-6.4%

1.9

1.8

Total

8.4%

8.8%

23.2

24.3

The result in 2013 was affected by three extraordinary and non-recurring items that on balance

had a positive effect on the result. Moreover, the resolution levy, a non-recurring levy resulting

from the nationalisation of SNS REAAL, will reduce the result by EUR 320 million in 2014.

Operating performance will improve in 2014.The return from the commercial divisions is

expected to rise. We expect costs to be lower in 2014, and also that impairments on real estate

and land holdings and value adjustments will be lower.

Rabobank expects economic growth in the Netherlands to be very modest in 2014.

Higher export growth is continuing, however a further decline in private consumption will

limit the rate of growth. In the light of this outlook, only marginal growth in lending is expected.

The recovery in the housing market appears to be continuing, and the prospects for the

development of the housing market in 2014 are favourable; a moderate increase in transaction

volume compared to 2013 is expected. Amounts due to customers will increase slightly, partly

due to higher deposits at the International Direct Retail Banking operations.

17 Financial developments