Financial results of wholesale banking and

international retail banking

Notes to financial results of wholesale banking

and international retail banking

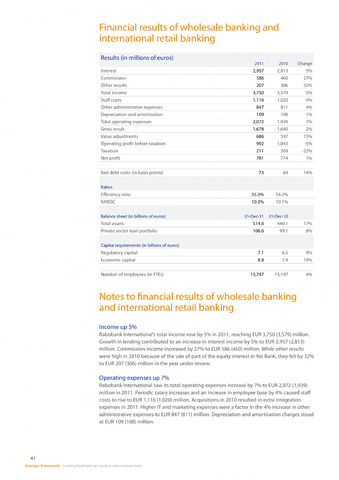

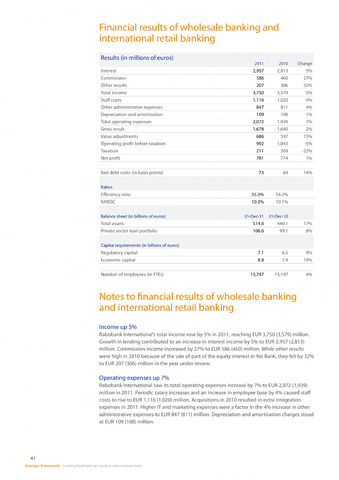

Results (in millions of euros)

Interest

2011

2,957

2010

2,813

Change

5%

Commission

586

460

27%

Other results

207

306

-32%

Total income

3,750

3,579

5%

Staff costs

1,116

1,020

9%

Other administrative expenses

847

811

4%

Depreciation and amortisation

109

108

1%

Total operating expenses

2,072

1,939

7%

Gross result

1,678

1,640

2%

Value adjustments

686

597

15%

Operating profit before taxation

992

1,043

-5%

Taxation

211

269

-22%

Net profit

781

774

1%

Bad debt costs (in basis points)

73

64

14%

Ratios

Efficiency ratio

55.3%

54.2%

RAROC

10.3%

10.1%

Balance sheet (in billions of euros)

Total assets

31-Dec-11

514.6

31-Dec-10

440.1

17%

Private sector loan portfolio

106.6

99.1

8%

Capital requirements (in billions of euros)

Regulatory capital

7.1

6.5

9%

Economic capital

8.8

7.4

19%

Number of employees (in FTEs)

15,747

15,197

4%

Income up 5%

Rabobank International's total income rose by 5% in 2011reaching EUR 3,750 (3,579) million.

Growth in lending contributed to an increase in interest income by 5% to EUR 2,957 (2,813)

million. Commission income increased by 27% to EUR 586 (460) million. While other results

were high in 2010 because of the sale of part of the equity interest in Yes Bank, they fell by 32%

to EUR 207 (306) million in the year under review.

Operating expenses up 7%

Rabobank International saw its total operating expenses increase by 7% to EUR 2,072 (1,939)

million in 2011Periodic salary increases and an increase in employee base by 4% caused staff

costs to rise to EUR 1,116 (1,020) million. Acquisitions in 2010 resulted in extra integration

expenses in 2011. Higher IT and marketing expenses were a factor in the 4% increase in other

administrative expenses to EUR 847 (811) million. Depreciation and amortisation charges stood

at EUR 109 (108) million.

41

Strategic Framework Leading food and agri bank at international level