Economic capital

Capital requirements

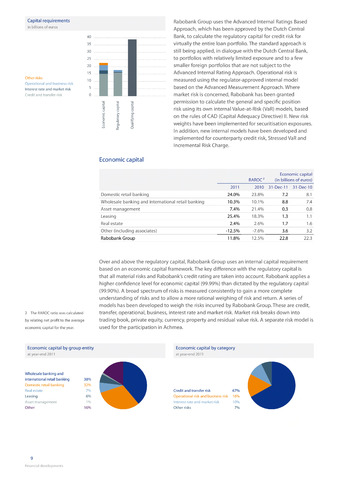

in billions of euros

Other risks

Operational and business risk

Interest rate and market risk

Credit and transfer risk

Rabobank Group uses the Advanced Internal Ratings Based

Approach, which has been approved by the Dutch Central

40 Bank, to calculate the regulatory capital for credit risk for

35 virtually the entire loan portfolio. The standard approach is

30 still being applied, in dialogue with the Dutch Central Bank,

25 to portfolios with relatively limited exposure and to a few

20 smaller foreign portfolios that are not subject to the

is Advanced Internal Rating Approach. Operational risk is

io measured using the regulator-approved internal model

5 based on the Advanced Measurement Approach. Where

o market risk is concerned, Rabobank has been granted

■a -s -a permission to calculate the general and specific position

g g risk using its own internal Value-at-Risk (VaR) models, based

o on the rules of CAD (Capital Adequacy Directive) II. New risk

8 !i H weights have been implemented for securitisation exposures.

LU 01 Q

In addition, new internal models have been developed and

implemented for counterparty credit risk, Stressed VaR and

Incremental Risk Charge.

Economic capital

RAROC2 (in billions of euros)

2011

2010

31-Dec-11

31-Dec-10

Domestic retail banking

24.0%

23.8%

7.2

8.1

Wholesale banking and international retail banking

10.3%

10.1%

8.8

7.4

Asset management

7.4%

21.4%

0.3

0.8

Leasing

25.4%

18.3%

1.3

1.1

Real estate

2.4%

2.6%

1.7

1.6

Other (including associates)

-12.5%

-7.6%

3.6

3.2

Rabobank Group

11.8%

12.5%

22.8

22.3

Over and above the regulatory capital, Rabobank Group uses an internal capital requirement

based on an economic capital framework. The key difference with the regulatory capital is

that all material risks and Rabobank's credit rating are taken into account. Rabobank applies a

higher confidence level for economic capital (99.99%) than dictated by the regulatory capital

(99.90%). A broad spectrum of risks is measured consistently to gain a more complete

understanding of risks and to allow a more rational weighing of risk and return. A series of

models has been developed to weigh the risks incurred by Rabobank Group. These are credit,

2 The raroc ratio was calculated transfer, operational, business, interest rate and market risk. Market risk breaks down into

by relating net profit to the average trading book, private equity, currency, property and residual value risk. A separate risk model is

economic capital for the year. used for the participation in Achmea.

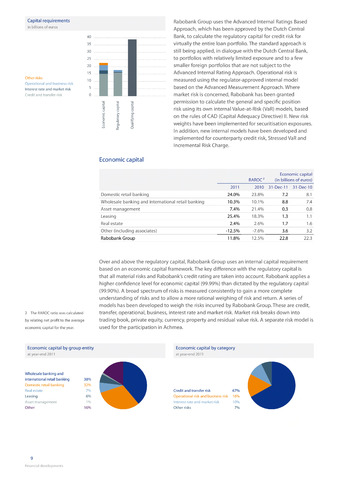

Economic capital by group entity

at year-end 2011

Wholesale banking and

international retail banking 38%

Domestic retail banking 32%

Real estate 7%

Leasing 6%

Asset management 1

Other 16%

Economic capital by category

at year-end 2011

Credit and transfer risk 67%

Operational risk and business risk 16%

Interest rate and market risk 10%

Other risks 7%

9

Financial developments