Financial results of wholesale banking and

international retail banking

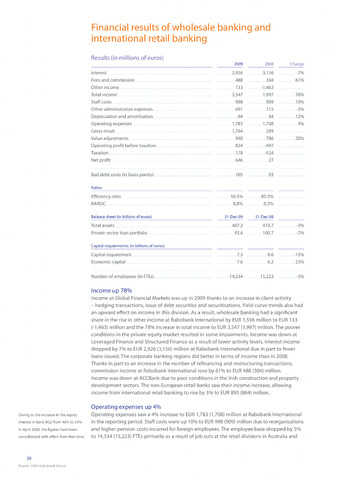

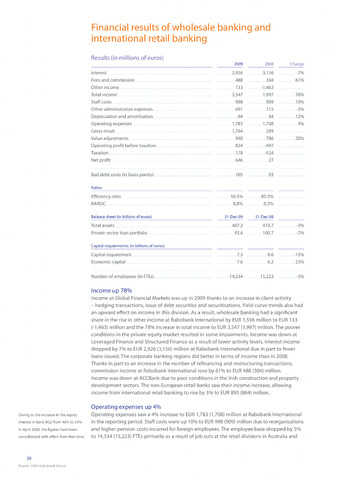

Results (in millions of euros)

Owing to the increase in the equity

interest in Bank BGZ from 46% to 59%

in April 2008, the figures have been

consolidated with effect from that time.

2009 2008 Change

Interest2,926 3,156 -7%

Fees and commission488. 304 61%

Other income1.33. -1,463

Total income3,547. 1,997 78%

Staff costs.998 909. 10%

Other administrative expenses..691715. -3%

Depreciation and amortisation94 84 12%

Operating, expenses1,7831,708 4%

Gross result1,764 289.

Value adjustments940 786 20%

Operating profit before taxation824 -497

Taxation178 -524

Net profit646 27

Bad debt costs (in basis points)10593.

Ratios

Efficiency, ratio50.3% 85.5%

RAROC8.8% 0.5%

Balance sheet (in billions of euros) 31-Dec-09 31-Dec-08

Total assets407.2 419.7 -3%

Private sector loan portfolio.93.4. 100.7 -7%

Capital requirements (in billions of euros)

Capital requirement7.3 8.6 15%

Economic capital7.6 6.2 23%

Number of employees (in fTEs)14,534 15,223 -5%

Income up 78%

Income at Global Financial Markets was up in 2009 thanks to an increase in client activity

- hedging transactions, issue of debt securities and securitisations. Yield curve trends also had

an upward effect on income in this division. As a result, wholesale banking had a significant

share in the rise in other income at Rabobank International by EUR 1,596 million to EUR 133

(-1,463) million and the 78% increase in total income to EUR 3,547 (1,997) million. The poorer

conditions in the private equity market resulted in some impairments. Income was down at

Leveraged Finance and Structured Finance as a result of lower activity levels. Interest income

dropped by 7% to EUR 2,926 (3,156) million at Rabobank International due in part to fewer

loans issued. The corporate banking regions did better in terms of income than in 2008.

Thanks in part to an increase in the number of refinancing and restructuring transactions,

commission income at Rabobank International rose by 61% to EUR 488 (304) million.

Income was down at ACCBank due to poor conditions in the Irish construction and property

development sectors. The non-European retail banks saw their income increase, allowing

income from international retail banking to rise by 3% to EUR 893 (864) million.

Operating expenses up 4%

Operating expenses saw a 4% increase to EUR 1,783 (1,708) million at Rabobank International

in the reporting period. Staff costs were up 10% to EUR 998 (909) million due to reorganisations

and higher pension costs incurred for foreign employees. The employee base dropped by 5%

to 14,534 (15,223) FTEs primarily as a result of job cuts at the retail divisions in Australia and

30

Report 2009 Rabobank Group