Key figures

.ll

loo BIB11

I I

I

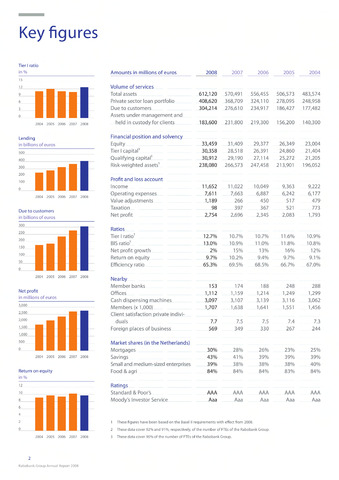

Tier I ratio

in

15

12

2004 2005 2006 2007 2008

Lending

in billions of euros

500

400

300H H

2004 2005 2006 2007 2008

Due to customers

in billions of euros

300

150

50

2004 2005 2006 2007 2008

Net profit

in millions of euros

3,000

2,500

2,000

1,500

1,000

500

2004 2005 2006 2007 2008

Return on equity

in

12

2004 2005 2006 2007 2008

1 These figures have been based on the Basel II requirements with effect from 2008.

2 These data cover 92% and 91%, respectively, of the number of FTEs of the Rabobank Group.

3 These data cover 90% of the number of FTEs of the Rabobank Group.

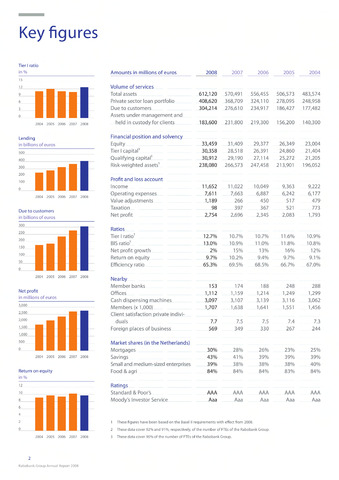

Amounts in millions of euros

2008

2007

2006

2005

2004

Volume of services

Total assets

612,120

570,491

556,455

506,573

483,574

Private sector loan portfolio

408,620

368,709

324,110

278,095

248,958

Due to customers

304,214

276,610

234,917

186,427

177,482

Assets under management and

held in custody for clients

183,600

231,800

219,300

156,200

140,300

Financial position and solvency

Equity

33,459

31,409

29,377

26,349

23,004

Tier I capital1

30,358

28,518

26,391

24,860

21,404

Qualifying capital1

30,912

29,190

27,114

25,272

21,205

Risk-weighted assets1

238,080

266,573

247,458

213,901

196,052

Profit and loss account

Income

11,652

11,022

10,049

9,363

9,222

Operating expenses

7,611

7,663

6,887

6,242

6,177

Value adjustments

1,189

266

450

517

479

Taxation

98

397

367

521

773

Net profit

2,754

2,696

2,345

2,083

1,793

Ratios

Tier 1 ratio1

12.7%

10.7%

10.7%

11.6%

10.9%

BIS ratio1

13.0%

10,9%

11.0%

11.8%

10.8%

Net profit growth

2%

15%

13%

16%

12%

Return on equity

9.7%

10.2%

9.4%

9.7%

9.1%

Efficiency ratio

65.3%

69.5%

68.5%

66.7%

67.0%

Nearby

Member banks

153

174

188

248

288

Offices

1,112

1,159

1,214

1,249

1,299

Cash dispensing machines

3,097

3,107

3,139

3,116

3,062

Members (x 1,000)

1,707

1,638

1,641

1,551

1,456

Client satisfaction private indivi

duals

7.7

7.5

7.5

7.4

7.3

Foreign places of business

569

349

330

267

244

Market shares (in the Netherlands)

Mortgages

30%

28%

26%

23%

25%

Savings

43%

41

39%

39%

39%

Small and medium-sized enterprises

39%

38%

38%

38%

40%

Food agri

84%

84%

84%

83%

84%

Ratings

Standard Poor's

AAA

AAA

AAA

AAA

AAA

Moody's Investor Service

Aaa

Aaa

Aaa

Aaa

Aaa

2

Rabobank Group Annual Report 2008