particularly for China and India. The activities of

Trade Commodity Finance in the food agri

sector will be intensified and will be expanded

to include metals and energy in order to

leverage the specific knowledge gained.

Despite increased competition, Global

Financial Markets expects to achieve further

growth in 2007.

As for the international retail banking business,

2007 will be characterised by further integration

of the activities. Mid-State Bank Trust will be

consolidated with existing activities. Offering

new products and attracting new clients will

result in further growth of the retail banking

network. Moreover, further expansion in both

the number of clients and the product range,

due in part to one or more new country

entries, should result in continued growth of

the Direct Banking activities this coming year.

It is expected that significant efforts will also

be required in 2007 to comply with new regu

lations.

www.raboparticipaties.nl

www.rabospecialproducts.com

For more information

www.rabobank.com

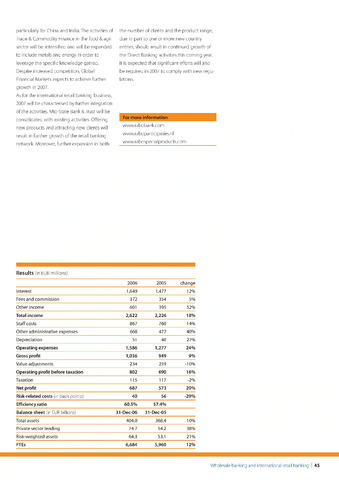

Results (in EUR millions)

2006

2005

change

Interest

1,649

1,477

12%

Fees and commission

372

354

5%

Other income

601

395

52%

Total income

2,622

2,226

18%

Staff costs

867

760

14%

Other administrative expenses

668

477

40%

Depreciation

51

40

27%

Operating expenses

1,586

1,277

24%

Gross profit

1,036

949

9%

Value adjustments

234

259

-10%

Operating profit before taxation

802

690

16%

Taxation

115

117

-2%

Net profit

687

573

20%

Risk-related costs (in basis points)

40

56

-29%

Efficiency ratio

60.5%

57.4%

Balance sheet (in EUR billions)

31-Dec-06

31-Dec-05

Total assets

404.0

368.4

10%

Private sector lending

74.7

54.2

38%

Risk-weighted assets

64.3

53.1

21%

FTEs

6,684

5,960

12%

Wholesale banking and international retail banking 45