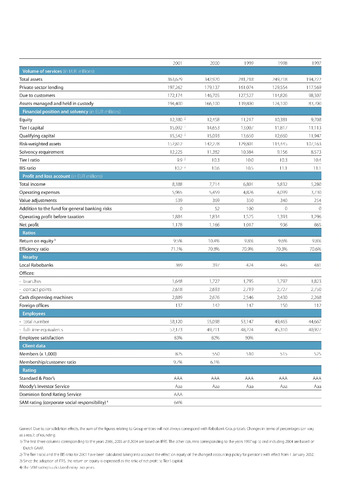

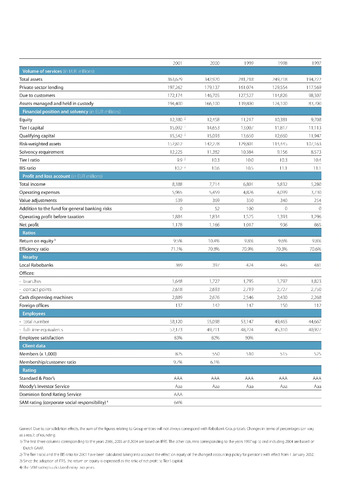

2001

2000

1999

1998

1997

Volume of services (in EUR millions)

Total assets

363,679

342,920

281,218

249,718

194,222

Private sector lending

197,262

179,137

161,074

129,554

117,569

Due to customers

172,174

146,705

127,527

114,826

98,307

Assets managed and held in custody

194,400

166,100

139,800

124,100

83,700

Financial position and solvency (in EUR millions)

Equity

12,380 2

12,458

11,217

10,381

9,708

Tier I capital

15,092 2

14,653

13,007

11,817

11,113

Qualifying capital

15,542 2

15,093

13,650

12,660

11,947

Risk-weighted assets

152,812

142,278

129,801

114,445

107,163

Solvency requirement

12,225

11,382

10,384

9,156

8,573

Tier I ratio

9.9 2

10.3

10.0

10.3

10.4

BIS ratio

10.2 2

10.6

10.5

11.1

11.1

Profit and loss account (in EUR millions)

Total income

8,388

7,714

6,801

5,832

5,280

Operating expenses

5,965

5,459

4,826

4,099

3,730

Value adjustments

539

369

350

340

254

Addition to the fund for general banking risks

0

52

100

0

0

Operating profit before taxation

1,884

1,834

1,525

1,393

1,296

Net profit

1,178

1,166

1,017

936

865

Ratios

Return on equity 3

9.5%

10.4%

9.8%

9.6%

9.8%

Efficiency ratio

71.1%

70.8%

70.9%

70.3%

70.6%

Nearby

Local Rabobanks

369

397

424

445

481

Offices:

- branches

1 ,648

1,727

1,795

1,797

1,823

- contact points

2,618

2,693

2,719

2,727

2,750

Cash dispensing machines

2,889

2,676

2,546

2,430

2,268

Foreign offices

137

142

147

150

112

Employees

- total number

58,120

55,098

53,147

49,465

44,667

- full-time equivalents

52,173

49,711

48,224

45,310

40,927

Employee satisfaction

83%

82%

80%

Client data

Members (x 1,000)

825

550

510

515

525

Membership/customer ratio

9.7%

6.1%

Rating

Standard Poor's

AAA

AAA

AAA

AAA

AAA

Moody's Investor Service

Aaa

Aaa

Aaa

Aaa

Aaa

Dominion Bond Rating Service

AAA

SAM rating (corporate social responsibility) 4

64%

General: Due to consolidation effects, the sum of the figures relating to Group entities will not always correspond with Rabobank Group totals. Changes in terms of percentages can vary

as a result of rounding.

1) The first three columns corresponding to the years 2006, 2005 and 2004 are based on IFRS. The other columns corresponding to the years 1997 up to and including 2004 are based on

Dutch GAAP.

2) The Tier I ratio and the BIS ratio for 2001 have been calculated taking into account the effect on equity of the changed accounting policy for pensions with effect from 1 January 2002.

3) Since the adoption of IFRS, the return on equity is expressed as the ratio of net profit to Tier I capital.

4) The SAM rating is calculated every two years.