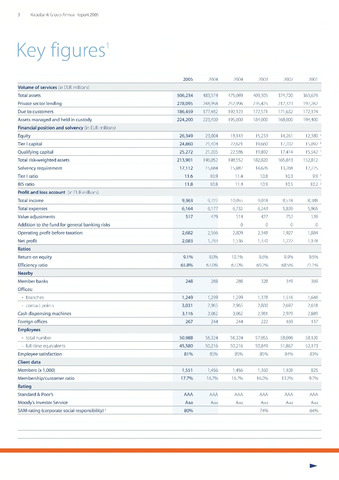

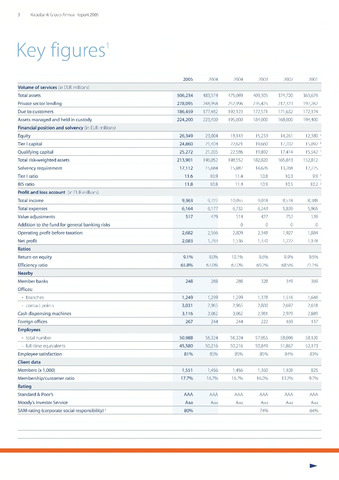

Key figures1

3 Rabobank Group Annual Report 2005

2005

2004

2004

2003

2002

2001

Volume of services (in EUR millions)

Total assets

506,234

483,574

475,089

403,305

374,720

363,679

Private sector lending

278,095

248,958

252,996

235,425

212,323

197,262

Due to customers

186,459

177,482

192,123

172,571

171,632

172,174

Assets managed and held in custody

224,200

223,400

195,000

184,000

168,000

194,400

Financial position and solvency (in EUR millions)

Equity

26,349

23,004

18,143

15,233

14,261

12,380 2

Tier I capital

24,860

21,404

22,621

19,660

17,202

15,092 2

Qualifying capital

25,272

21,205

22,586

19,892

17,414

15,542 2

Total risk-weighted assets

213,901

196,052

198,552

182,820

165,843

152,812

Solvency requirement

17,112

15,684

15,887

14,626

13,268

12,225

Tier I ratio

11.6

10.9

11.4

10.8

10.3

9.9 2

BIS ratio

11.8

10.8

11.4

10.9

10.5

10.2 2

Profit and loss account (in EUR millions)

Total income

9,363

9,222

10,055

9,018

8,518

8,388

Total expenses

6,164

6,177

6,732

6,243

5,839

5,965

Value adjustments

517

479

514

427

752

539

Addition to the fund for general banking risks

0

0

0

0

Operating profit before taxation

2,682

2,566

2,809

2,348

1,927

1,884

Net profit

2,083

1,793

1,536

1,370

1,222

1,178

Ratios

Return on equity

9.1%

9.0%

10.1%

9.6%

9.9%

9.5%

Efficiency ratio

65.8%

67.0%

67.0%

69.2%

68.5%

71.1%

Nearby

Member banks

248

288

288

328

349

369

Offices:

- branches

1,249

1,299

1,299

1,378

1,516

1,648

- contact points

3,031

2,965

2,965

2,800

2,697

2,618

Cash dispensing machines

3,116

3,062

3,062

2,981

2,979

2,889

Foreign offices

267

244

244

222

169

137

Employees

- total number

50,988

56,324

56,324

57,055

58,096

58,120

- full-time equivalents

45,580

50,216

50,216

50,849

51,867

52,173

Employee satisfaction

81%

85%

85%

85%

84%

83%

Client data

Members (x 1,000)

1,551

1,456

1,456

1,360

1,108

825

Membership/customer ratio

17.7%

16.7%

16.7%

16.0%

13.2%

9.7%

Rating

Standard Poor's

AAA

AAA

AAA

AAA

AAA

AAA

Moody's Investor Service

Aaa

Aaa

Aaa

Aaa

Aaa

Aaa

SAM-rating (corporate social responsibility) 3

80%

74%

64%