The Russia

house

Rabobank

International

What's NewS

Issue 11 November 1996

As the bank finalizes its rep office licence application in

Moscow, the Russians have actually come to the bank in

Utrecht. The Minister of Agriculture, Viktor Khlystun,

looked on as RIAS, our consultancy subsidiary, the

Russian Agroprombank and Interagrofond signed a joint

venture agreement to set up an advisory service there.

Although the new enterprise is still lacking a name, its

goals are firmly established. Agroprombank, Russia's

dedicated F&A bank with an extensive nationwide

network, and Interagrofond, which provides guarantees

for finance for the agricultural sector, will represent a

strong framework for the application of RI's own

expertise. Services soon to be availabie in Russia include

privatization and restructuring, business and investment

planning, marketing strategy and technological

development, management support and consultancy, and

- perhaps most interesting for the rest of the network -

advice on business partner selection.

For more on our Russian connection, see page 11.

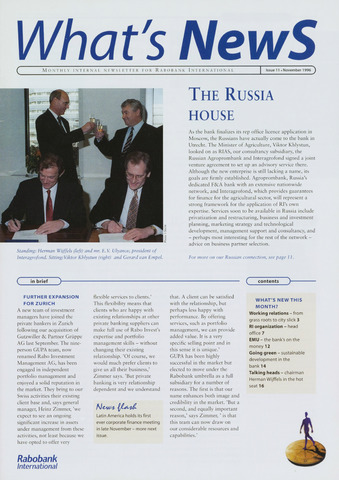

Standing: Herman Wijffels (left) and mr. E.V. Ulyanov, president of

Interagrofond. SittingdViktor Khlystun (right) and Gerard van Empel.

in brief "*)-

contents

FURTHER EXPANStON

FOR ZURICH

A new team of investment

managers have joined the

private bankers in Zurich

following our acquisition of

Gutzwiller Partner Grüppe

AG last September. The nine-

person GUPA team, now

renamed Rabo Investment

Management AG, has been

engaged in independent

portfolio management and

enjoyed a solid reputation in

the market. They bring to our

Swiss activities their existing

cliënt base and, says general

manager, Heinz Zimmer, 'we

expect to see an ongoing

significant increase in assets

under management front these

activities, not least because we

have opted to offer very

flexible services to clients.'

This flexibility means that

clients who are happy with

existing relationships at other

private banking suppliers can

make full use of Rabo Invest's

expertise and portfolio

management skills - without

changing their existing

relationship. 'Of course, we

would rnuch prefer clients to

give us all their business,'

Zimmer says. 'But private

banking is very relationship

dependent and we understand

Latin America holds its first

ever corporate finance meeting

in late November - more next

issue.

that. A cliënt can be satisfied

with the relationship, but

perhaps less happy with

performance. By offering

services, such as portfolio

management, we can provide

added value. It is a very

specific selling point and in

this sense it is unique.'

GUPA has been highly

successful in the market but

elected to move under the

Rabobank umbrella as a full

subsidiary for a number of

reasons. The first is that our

name enhances both image and

credibility in the market. 'But a

second, and equally important

reason,' says Zimmer, is that

this team can now draw on

our considerable resources and

capabilities.'

WHAT'S NEW THIS

MONTH?

Working relations - from

grass roots to city slick 3

Rl organization - head

office 7

EMU - the bank's on the

money12

Going green - sustainable

development in the

bank 14

Talking heads - chairman

Herman Wijffels in the hot

seat 16

i