Vigorous growth in activities

and financial performance

at Rabobank in 1989

Rabo

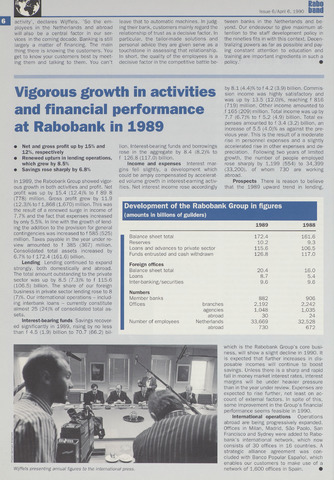

Development of the Rabobank Group in figures

activity', declares Wijffels. 'So the em

ployees in the Netherlands and abroad

will also be a central factor in our ser

vices in the coming decade. Banking is still

largely a matter of financing. The main

thing there is knowing the customers. You

get to know your customers best by meet

ing them and talking to them. You can't

leave that to automatic machines. In judg-

ing their bank, customers mainly regard the

relationship of trust as a decisive factor. In

particular, the tailor-made solutions and

personal advice they are given serve as a

touchstone in assessing that relationship.

In short, the quality of the employees is a

decisive factor in the competitive battle be-

Issue 6/April 6, 1990 band

tween banks in the Netherlands and be-

yond. Our endeavour to give maximum at-

tention to the staff development policy in

the nineties fits in with this context. Decen-

tralizing powers as far as possible and pay-

ing constant attention to education and

training are important ingredients in such a

poiicy.'

Net and gross profit up by 15% and

12%, respectively

Renewed upturn in lending operations,

which grew by 8.5%

Savings rose sharply by 6.8%

In 1989, the Rabobank Group showed vigor

ous growth in both activities and profit. Net

profit was up by 15.4 (12.4)% to f 89 8

(778) million. Gross profit grew by 11.9

(12.3)% to f 1,868 (1,670) million. This was

the result of a renewed surge in income of

7.7% and the fact that expenses increased

by only 5.5%. In line with the growth of lend

ing the addition to the provision for general

contingencies was increased to f 585 (525)

million. Taxes payable in the year under re-

view amounted to f 385 (367) million.

Consolidated total assets increased by

6.7% to f 172.4 (161.6) billion.

Lending Lending continued to expand

strongly, both domestically and abroad.

The total amount outstanding to the private

sector was up by 8.5 (7.3)% to f 115.6

(106.5) billion. The share of our foreign

business in private sector lending rose to 8

(7)%. Our international operations - includ-

ing interbank loans - currently constitute

almost 25 (24)% of Consolidated total as-

sets.

Interest-bearing funds Savings recover-

ed significantly in 1989, rising by no less

than f 4.5 (1.9) billion to 70.7 (66.2) bil

lion. Interest-bearing funds and borrowings

rose in the aggregate by 8.4 (8.2)% to

f 126.8 (117.0) billion.

Income and expenses Interest mar-

gins feil slightly, a development which

could be amply compensated by accelerat-

ed volume growth in interest-earning activ

ities. Net interest income rose accordingly

by 8.1 (4.4)% to f 4.2 (3.9) billion. Commis-

sion income was highly satisfactory and

was up by 13.5 (12.0)%, reaching f 816

(719) million. Other income amounted to

J 165 (209) million. Total income was up by

7.7 (6.7)% to f 5.2 (4.9) billion. Total ex

penses amounted to f 3.4 (3.2) billion, an

increase of 5.5 (4.0)% as against the pre-

vious year. This is the result of a moderate

rise in personnel expenses and a slightly

accelerated rise in other expenses and de-

preciation. Following two years of limited

growth, the number of people employed

rose sharply by 1,199 (554) to 34,399

(33,200), of whom 730 are working

abroad.

Prospects There is reason to believe

that the 1989 upward trend in lending,

(amounts in billions of guilders)

1989 1988

Balance sheet total 172.4 161.6

Reserves 10.2 9.3

Loans and advances to private sector 115.6 106.5

Funds entrusted and cash withdrawn 126.8 117.0

Foreign offices

Balance sheet total 20.4 16.0

Loans 8.7 5.4

Inter-banking/securities 9.6 9.6

Numbers

Member banks 882 906

Offices branches 2,192 2,242

agencies 1,048 1,035

abroad 30 24

Number of employees Netherlands 33,669 32,528

abroad 730 672

Wijffels presenting annual figures to the international press.

which is the Rabobank Group's core busi

ness, will show a slight decline in 1990. It

is expected that further increases in dis-

posable incomes will continue to boost

savings. Unless there is a sharp and rapid

fall in money market interest rates, interest

margins will be under heavier pressure

than in the year under review. Expenses are

expected to rise further, not least on ac

count of external factors. In spite of this,

some improvement in the Group's financial

performance seems feasible in 1990.

International operations Operations

abroad are being progressively expanded.

Offices in Milan, Madrid, Sao Paolo, San

Francisco and Sydney were added to Rabo-

bank's international network, which now

consists of 30 offices in 16 countries. A

strategie alliance agreement was con-

cluded with Banco Popular Espanol, which

enables our customers to make use of a

network of 1,600 offices in Spain.