74.4 Countercyclical buffer by country and institution-specific countercyclical buffer rate

Inhoudsopgave Voorwoord Bestuursverslag Corporate governance Consolidated Financial Statements Company Financial Statements Pillar 3

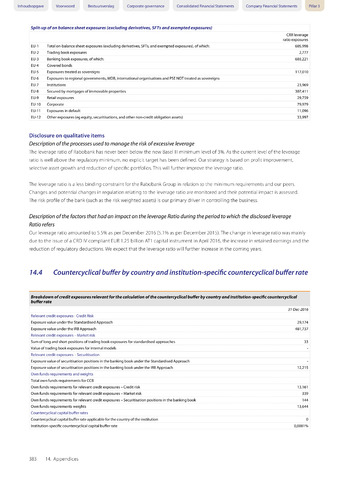

Split-up of on balance sheet exposures (excluding derivativesSFTs and exempted exposures)

EU-1 Total on-balance sheet exposures (excluding derivatives, SFTs, and exempted exposures), of which:

EU-2 Trading book exposures

EU-3 Banking book exposures, of which:

EU-4 Covered bonds

EU-5 Exposures treated as sovereigns

EU-6 Exposures to regional governments, MDB, international organisations and PSE NOT treated as sovereigns

EU-7 Institutions

EU-8 Secured by mortgages of immovable properties

EU-9 Retail exposures

EU-10 Corporate

EU-11 Exposures in default

EU-12 Other exposures (eg equity, securitisations, and other non-credit obligation assets)

CRR leverage

ratio exposures

605,998

2,777

603,221

117,010

23,969

307,411

29,759

79,979

11,096

33,997

Disclosure on qualitative items

Description of the processes used to manage the risk of excessive leverage

The leverage ratio of Rabobank has never been below the new Basel III minimum level of 3%. As the current level of the leverage

ratio is well above the regulatory minimum, no explicit target has been defined. Our strategy is based on profit improvement,

selective asset growth and reduction of specific portfolios. This will further improve the leverage ratio.

The leverage ratio is a less binding constraint for the Rabobank Group in relation to the minimum requirements and our peers.

Changes and potential changes in regulation relating to the leverage ratio are monitored and their potential impact is assessed.

The risk profile of the bank (such as the risk weighted assets) is our primary driver in controlling the business.

Description of the factors that had an impact on the leverage Ratio during the period to which the disclosed leverage

Ratio refers

Our leverage ratio amounted to 5.5% as per December 2016 (5.1% as per December 2015). The change in leverage ratio was mainly

due to the issue ofa CRD IV compliant EUR 1.25 billion AT1 capital instrument in April 2016, the increase in retained earnings and the

reduction of regulatory deductions. We expect that the leverage ratio will further increase in the coming years.

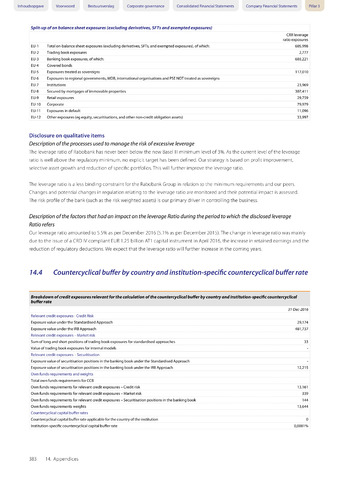

Breakdown of credit exposures relevant for the calculation of the countercyclical buffer by country and institution-specific countercyclical

buffer rate

31-Dec-2016

Relevant credit exposures - Credit Risk

Exposure value under the Standardised Approach

Exposure value under the IRB Approach

Relevant credit exposures - Market risk

Sum of long and short positions of trading book exposures for standardised approaches

Value of trading book exposures for internal models

Relevant credit exposures - Securitisation

Exposure value of securitisation positions in the banking book under the Standardised Approach

Exposure value of securitisation positions in the banking book under the IRB Approach

Own funds requirements and weights

Total own funds requirements for CCB

Own funds requirements for relevant credit exposures - Credit risk

Own funds requirements for relevant credit exposures - Market risk

Own funds requirements for relevant credit exposures - Securitisation positions in the banking book

Own funds requirements weights

Countercyclical capital buffer rates

Countercyclical capital buffer rate applicable for the country of the institution

Institution-specific countercyclical capital buffer rate

0,0081%

29,174

481,737

12,215

13,161

339

144

13,644

33

0

383 14. Appendices