Inhoudsopgave Voorwoord Bestuursverslag Corporate governance Consolidated Financial Statements Company Financial Statements Pillar 3

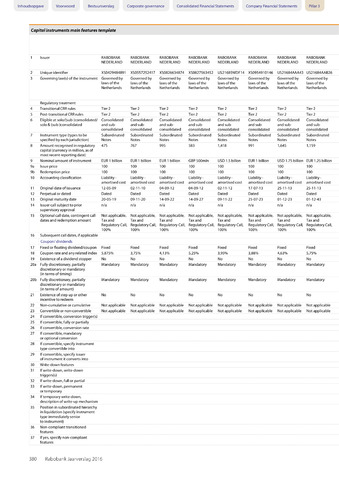

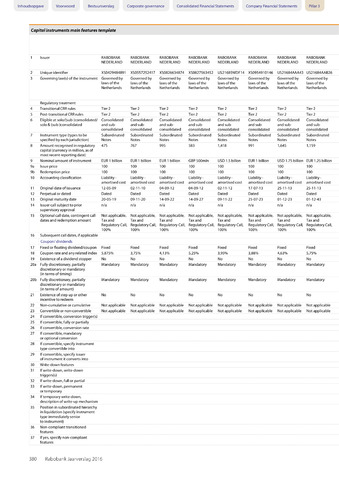

Capital instruments main features template

1

Issuer

RABOBANK

NEDERLAND

RABOBANK

NEDERLAND

RABOBANK

NEDERLAND

RABOBANK

NEDERLAND

RABOBANK

NEDERLAND

RABOBANK

NEDERLAND

RABOBANK

NEDERLAND

RABOBANK

NEDERLAND

2

Unique identifier

XS0429484891

XS0557252417

XS0826634874

XS0827563452

US21685WDF14

XS0954910146

US21684AAA43

US21684AAB26

3

Governing law(s) of the instrument

Governed by

laws of the

Netherlands

Governed by

laws of the

Netherlands

Governed by

laws of the

Netherlands

Governed by

laws of the

Netherlands

Governed by

laws of the

Netherlands

Governed by

laws of the

Netherlands

Governed by

laws of the

Netherlands

Governed by

laws of the

Netherlands

Regulatory treatment

4

Transitional CRR rules

Tier 2

Tier 2

Tier 2

Tier 2

Tier 2

Tier 2

Tier 2

Tier 2

5

Post-transitional CRR rules

Tier 2

Tier 2

Tier 2

Tier 2

Tier 2

Tier 2

Tier 2

Tier 2

6

Eligible at solo/(sub-)consolidated/

solo& (sub-)consolidated

Consolidated

and sub-

consolidated

Consolidated

and sub-

consolidated

Consolidated

and sub-

consolidated

Consolidated

and sub-

consolidated

Consolidated

and sub-

consolidated

Consolidated

and sub-

consolidated

Consolidated

and sub-

consolidated

Consolidated

and sub-

consolidated

7

Instrument type (types to be

specified by each jurisdiction)

Subordinated

Notes

Subordinated

Notes

Subordinated

Notes

Subordinated

Notes

Subordinated

Notes

Subordinated

Notes

Subordinated

Notes

Subordinated

Notes

8

Amount recognised in regulatory

capital (currency in million, as of

most recent reporting date)

475

767

995

583

1,418

991

1,645

1,159

9

Nominal amount of instrument

EUR 1 billion

EUR 1 billion

EUR 1 billion

GBP 500mln

USD 1.5 billon

EUR 1 billion

USD 1.75 billion

EUR 1.25 billion

9a

Issue price

100

100

100

100

100

100

100

100

9b

Redemption price

100

100

100

100

100

100

100

100

10

Accounting classification

Liability-

amortised cost

Liability-

amortised cost

Liability-

amortised cost

Liability-

amortised cost

Liability-

amortised cost

Liability -

amortised cost

Liability-

amortised cost

Liability-

amortised cost

11

Original date of issuance

12-05-09

02-11-10

04-09-12

04-09-12

02-11-12

17-07-13

25-11-13

25-11-13

12

Perpetual or dated

Dated

Dated

Dated

Dated

Dated

Dated

Dated

Dated

13

Original maturity date

20-05-19

09-11-20

14-09-22

14-09-27

09-11-22

25-07-23

01-12-23

01-12-43

14

Issuer call subject to prior

supervisory approval

n/a

n/a

n/a

n/a

n/a

n/a

n/a

n/a

15

Optional call date, contingent call

dates and redemption amount

Not applicable,

Tax and

Regulatory Call,

100%

Not applicable,

Tax and

Regulatory Call,

100%

Not applicable,

Tax and

Regulatory Call,

100%

Not applicable,

Tax and

Regulatory Call,

100%

Not applicable,

Tax and

Regulatory Call,

100%

Not applicable,

Tax and

Regulatory Call,

100%

Not applicable,

Tax and

Regulatory Call,

100%

Not applicable,

Tax and

Regulatory Call,

100%

16

Subsequent call dates, if applicable

Coupon/ dividends

17

Fixed or floating dividend/coupon

Fixed

Fixed

Fixed

Fixed

Fixed

Fixed

Fixed

Fixed

18

Coupon rate and any related index

5,875%

3,75%

4,13%

5,25%

3,95%

3,88%

4,63%

5,75%

19

Existence of a dividend stopper

No

No

No

No

No

No

No

No

20a

Fully discretionary, partially

discretionary or mandatory

(in terms of timing)

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

20b

Fully discretionary, partially

discretionary or mandatory

(in terms of amount)

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

21

Existence of step up or other

incentive to redeem

No

No

No

No

No

No

No

No

22

Non-cumulative or cumulative

Not applicable

Not applicable

Not applicable

Not applicable

Not applicable

Not applicable

Not applicable

Not applicable

23

Convertible or non-convertible

Not applicable

Not applicable

Not applicable

Not applicable

Not applicable

Not applicable

Not applicable

Not applicable

24 If convertible, conversion trigger(s)

25 If convertible, fully or partially

26 If convertible, conversion rate

27 If convertible, mandatory

or optional conversion

28 If convertible, specify instrument

type convertible into

29 If convertible, specify issuer

of instrument it converts into

30 Write-down features

31 If write-down, write-down

triggers(s)

32 If write-down, full or partial

33 If write-down, permanent

or temporary

34 If temporary write-down,

description of write-up mechanism

35 Position in subordinated hierarchy

in liquidation (specify instrument

type immediately senior

to instrument)

36 Non-compliant transitioned

features

37 If yes, specify non-compliant

features

380 Rabobank Jaarverslag 2016