-

-

-

-

-

-

-

Inhoudsopgave Voorwoord Bestuursverslag Corporate governance Consolidated Financial Statements Company Financial Statements Pillar 3

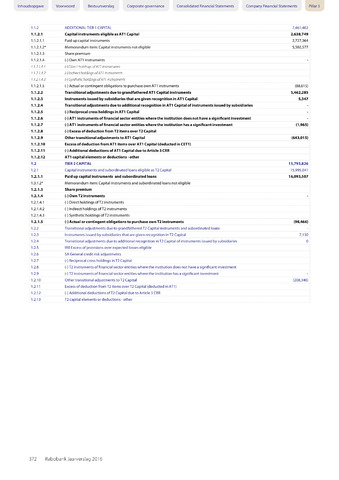

1.1.2

ADDITIONALTIER 1 CAPITAL

7,461,402

1.1.2.1

Capital instruments eligible as ATI Capital

2,638,749

1.1.2.1.1

Paid up capital instruments

2,727,364

1.1.2.1.2*

Memorandum item: Capital instruments not eligible

5,502,577

1.1.2.1.3

Share premium

1.1.2.1.4

(-) Own AT1 instruments

1.1.2.1.4.1

(-) Direct holdings of ATI instruments

1.1.2.1.4.2

(-) Indirect holdings ofAT1 instruments

1.1.2.1.4.3

(-) Synthetic holdings ofAT1 instruments

1.1.2.1.5

(-) Actual or contingent obligations to purchase own AT1 instruments

(88,615)

1.1.2.2

Transitional adjustments due to grandfathered ATI Capital instruments

5,462,285

1.1.2.3

Instruments issued by subsidiaries that are given recognition in ATI Capital

5,347

1.1.2.4

Transitional adjustments due to additional recognition in ATI Capital of instruments issued by subsidiaries

1.1.2.5

(-) Reciprocal cross holdings in ATI Capital

1.1.2.6

(-) AT1 instruments of financial sector entities where the institution does not have a significant investment

1.1.2.7

(-) AT1 instruments of financial sector entities where the institution has a significant investment

(1,965)

1.1.2.8

(-) Excess of deduction from T2 items over T2 Capital

1.1.2.9

Other transitional adjustments to ATI Capital

(643,015)

1.1.2.10

Excess of deduction from ATI items over ATI Capital (deducted in CET1

1.1.2.11

(-) Additional deductions of ATI Capital due to Article 3 CRR

1.1.2.12

ATI capital elements or deductions - other

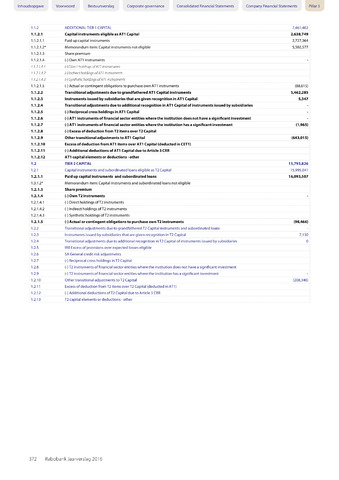

1.2

TIER 2 CAPITAL

15,793,826

1.2.1

Capital instruments and subordinated loans eligible as T2 Capital

15,995,041

1.2.1.1

Paid up capital instruments and subordinated loans

16,093,507

1.3.1.2*

Memorandum item: Capital instruments and subordinated loans not eligible

1.2.1.3

Share premium

1.2.1.4

(-) Own T2 instruments

1.2.1.4.1

(-) Direct holdings of T2 instruments

1.2.1.4.2

(-) Indirect holdings of T2 instruments

1.2.1.4.3

(-) Synthetic holdings of T2 instruments

1.2.1.5

(-) Actual or contingent obligations to purchase own T2 instruments

(98,466)

1.2.2

Transitional adjustments due to grandfathered T2 Capital instruments and subordinated loans

1.2.3

Instruments issued by subsidiaries that are given recognition in T2 Capital

7,130

1.2.4

Transitional adjustments due to additional recognition inT2 Capital of instruments issued by subsidiaries

0

1.2.5

IRB Excess of provisions over expected losses eligible

1.2.6

SA General credit risk adjustments

1.2.7

(-) Reciprocal cross holdings in T2 Capital

1.2.8

(-) T2 instruments of financial sector entities where the institution does not have a significant investment

1.2.9

(-) T2 instruments of financial sector entities where the institution has a significant investment

1.2.10

Other transitional adjustments to T2 Capital

(208,346)

1.2.11

Excess of deduction from T2 items overT2 Capital (deducted in AT1)

1.2.12

(-) Additional deductions of T2 Capital due to Article 3 CRR

1.2.13

T2 capital elements or deductions - other

372 Rabobank Jaarverslag 2016