-

-

Inhoudsopgave Voorwoord Bestuursverslag Corporate governance Consolidated Financial Statements Company Financial Statements Pillar 3

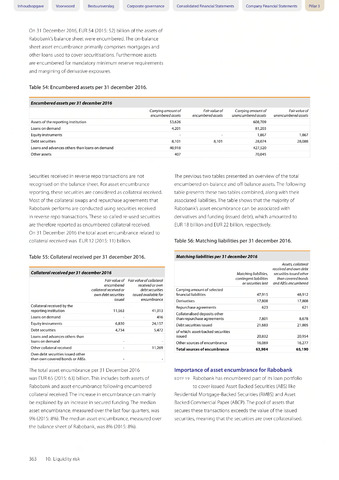

Encumbered assets per 31 december 2016

Carrying amount of

encumbered assets

Fair value of

encumbered assets

Carrying amount of

unencumbered assets

Fair value of

unencumbered assets

Assets ofthe reporting institution

53,626

608,709

Loans on demand

4,201

81,203

Equity instruments

1,867

1,867

Debt securities

8,101

8,101

28,074

28,088

Loans and advances others than loans on demand

40,918

427,520

Other assets

407

70,045

On 31 December 2016, EUR 54 (2015: 52) billion ofthe assets of

Rabobank's balance sheet were encumbered.The on-balance

sheet asset encumbrance primarily comprises mortgages and

other loans used to cover securitisations. Furthermore assets

are encumbered for mandatory minimum reserve requirements

and margining of derivative exposures.

Table 54: Encumbered assets per 31 december 2016.

Securities received in reverse repo transactions are not

recognised on the balance sheet. For asset encumbrance

reporting, these securities are considered as collateral received.

Most ofthe collateral swaps and repurchase agreements that

Rabobank performs are conducted using securities received

in reverse repo transactions. These so-called re-used securities

are therefore reported as encumbered collateral received.

On 31 December 2016 the total asset encumbrance related to

collateral received was EUR 12 (2015:11) billion.

Table 55: Collateral received per 31 december 2016.

Collateral received per 31 december20 7 6

Fair value of Fair value of col la teral

encumbered received or own

collateral received or debt securities

own debt securities issued available for

issued encumbrance

Collateral received by the

reporting institution 11,563 41,313

Loans on demand - 416

Equity instruments 6,830 24,157

Debt securities 4,734 5,472

Loans and advances others than

loans on demand

Other collateral received - 11,269

Own debt securities issued other

than own covered bonds or ABSs

The total asset encumbrance per 31 December 2016

was EUR 65 (2015: 63) billion.This includes both assets of

Rabobank and asset encumbrance following encumbered

collateral received.The increase in encumbrance can mainly

be explained by an increase in secured funding. The median

asset encumbrance, measured over the last four quarters, was

9% (2015: 8%).The median asset encumbrance, measured over

the balance sheet of Rabobank, was 8% (2015:8%).

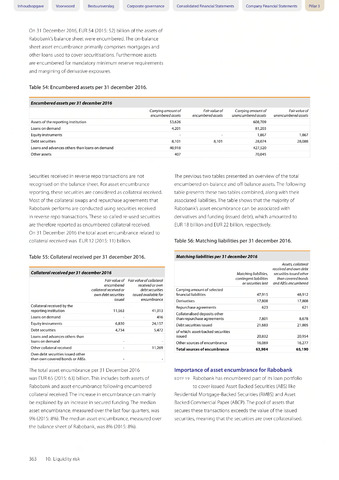

The previous two tables presented an overview of the total

encumbered on-balance and off-balance assets. The following

table presents these two tables combined, along with their

associated liabilities.The table shows that the majority of

Rabobank's asset encumbrance can be associated with

derivatives and funding (issued debt), which amounted to

EUR 18 billion and EUR 22 billion, respectively.

Table 56: Matching liabilities per 31 december 2016.

Importance of asset encumbrance for Rabobank

edtf 19 Rabobank has encumbered part of its loan portfolio

to cover issued Asset Backed Securities (ABS) like

Residential Mortgage-Backed Securities (RMBS) and Asset

Backed Commercial Paper (ABCP).The pool of assets that

secures these transactions exceeds the value ofthe issued

securities, meaning that the securities are over collateralised.

Matching liabilities per 31 december 2016

Matching liabilities,

con tingen t liabilities

or securities lent

Assets, collateral

received and own debt

securities issued other

than covered bonds

and ABSs encumbered

Carrying amount of selected

financial liabilities

47,915

48,912

Derivatives

17,808

17,808

Repurchase agreements

623

621

Collateralised deposits other

than repurchase agreements

7,801

8,678

Debt securities issued

21,683

21,805

of which: asset-backed securities

issued

20,832

20,954

Other sources of encumbrance

16,069

16,277

Total sources of encumbrance

63,984

65,190

363 10. Liquidity risk