5.3 Economic Capital

Inhoudsopgave Voorwoord Bestuursverslag Corporate governance Consolidated Financial Statements Company Financial Statements Pillar 3

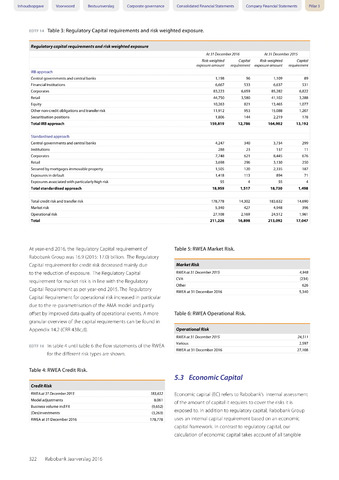

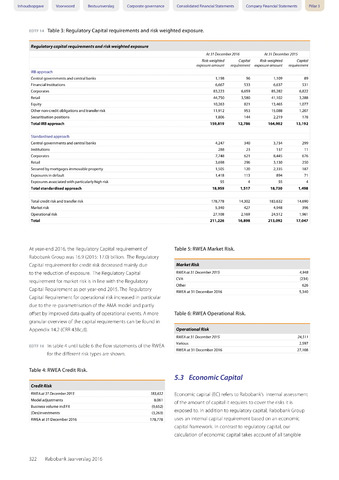

edtf 14 Table 3: Regulatory Capital requirements and risk weighted exposure.

Regulatory capital requirements and risk weighted exposure

At31 December 2016 At 31 December 2015

Risk-weighted

Capital

Risk-weighted

Capital

exposure amount

requirement

exposure amount

requirement

IRB approach

Central governments and central banks

1,198

96

1,109

89

Financial Institutions

6,667

533

6,637

531

Corporates

83,223

6,659

85,282

6,822

Retail

44,750

3,580

41,102

3,288

Equity

10,263

821

13,465

1,077

Other non-credit obligations and transfer risk

11,912

953

15,088

1,207

Securitisation positions

1,806

144

2,219

178

Total IRB approach

159,819

12,786

164,902

13,192

Standardised approach

Central governments and central banks

4,247

340

3,734

299

Institutions

288

23

137

11

Corporates

7,748

621

8,445

676

Retail

3,698

296

3,130

250

Secured by mortgages immovable property

1,505

120

2,335

187

Exposures in default

1,418

113

894

71

Exposures associated with particularly high risk

55

4

55

4

Total standardised approach

18,959

1,517

18,730

1,498

Total credit risk and transfer risk

178,778

14,302

183,632

14,690

Market risk

5,340

427

4,948

396

Operational risk

27,108

2,169

24,512

1,961

Total 211,226 16,898 213,092 17,047

At year-end 2016, the Regulatory Capital requirement of

Rabobank Group was 16.9 (2015:17.0) billion. The Regulatory

Capital requirement for credit risk decreased mainly due

to the reduction of exposure. The Regulatory Capital

requirement for market risk is in line with the Regulatory

Capital Requirement as per year-end 2015. The Regulatory

Capital Requirement for operational risk increased in particular

due to the re-parametrisation of the AMA model and partly

offset by improved data quality of operational events. A more

granular overview of the capital requirements can be found in

Appendix 14.2 (CRR438c,d).

edtf 16 In table 4 until table 6 the flow statements of the RWEA

for the different risk types are shown.

Table 4: RWEA Credit Risk.

Table 5: RWEA Market Risk.

Market Risk

RWEA at 31 December2015 4,948

CVA (234)

Other 626

RWEA at 31 December 2016 5,340

Table 6: RWEA Operational Risk.

Operational Risk

RWEA at 31 December2015 24,511

Various 2,597

RWEA at 31 December 2016 27,108

Economic capital (EC) refers to Rabobank's internal assessment

of the amount of capital it requires to cover the risks it is

exposed to. In addition to regulatory capital, Rabobank Group

uses an internal capital requirement based on an economic

capital framework. In contrast to regulatory capital, our

calculation of economic capital takes account of all tangible

Credit Risk

RWEA at 31 December2015

183,632

Model adjustments

8,061

Business volume incl FX

(9,652)

(Des) investments

(3,263)

RWEA at 31 December 2016

178,778

322 Rabobank Jaarverslag 2016