-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

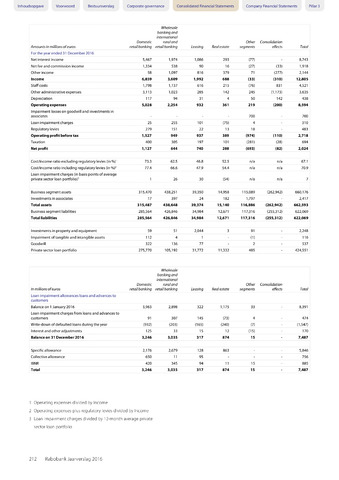

Inhoudsopgave Voorwoord Bestuursverslag Corporate governance Consolidated Financial Statements Company Financial Statements Pillar 3

Amounts in millions of euros

Domestic

retail banking

Wholesale

banking and

international

rural and

retail banking

Leasing

Real estate

Other

segments

Consolidation

effects

Total

For the year ended 31 December 2016

Net interest income

5,467

1,974

1,086

293

(77)

8,743

Net fee and commission income

1,334

538

90

16

(27)

(33)

1,918

Other income

58

1,097

816

379

71

(277)

2,144

Income

6,859

3,609

1,992

688

(33)

(310)

12,805

Staff costs

1,798

1,137

616

215

(76)

831

4,521

Other administrative expenses

3,113

1,023

285

142

245

(1,173)

3,635

Depreciation

117

94

31

4

50

142

438

Operating expenses

5,028

2,254

932

361

219

(200)

8,594

Impairment losses on goodwill and investments in

associates

700

700

Loan impairment charges

25

255

101

(75)

4

310

Regulatory levies

279

151

22

13

18

483

Operating profit before tax

1,527

949

937

389

(974)

(110)

2,718

Taxation

400

305

197

101

(281)

(28)

694

Net profit

1,127

644

740

288

(693)

(82)

2,024

Cost/income ratio excluding regulatory levies (in %)1

73.3

62.5

46.8

52.5

n/a

n/a

67.1

Cost/income ratio including regulatory levies (in %)2

77.4

66.6

47.9

54.4

n/a

n/a

70.9

Loan impairment charges (in basis points of average

private sector loan portfolio)3

1

26

30

(54)

n/a

n/a

7

Business segment assets

315,470

438,251

39,350

14,958

115,089

(262,942)

660,176

Investments in associates

17

397

24

182

1,797

2,417

Total assets

315,487

438,648

39,374

15,140

116,886

(262,942)

662,593

Business segment liabilities

285,564

426,846

34,984

12,671

117,316

(255,312)

622,069

Total liabilities

285,564

426,846

34,984

12,671

117,316

(255,312)

622,069

Investments in property and equipment

59

51

2,044

3

91

2,248

Impairment of tangible and intangible assets

112

4

1

(1)

116

Goodwill

322

136

77

2

537

Private sector loan portfolio

275,770

105,192

31,772

11,332

485

424,551

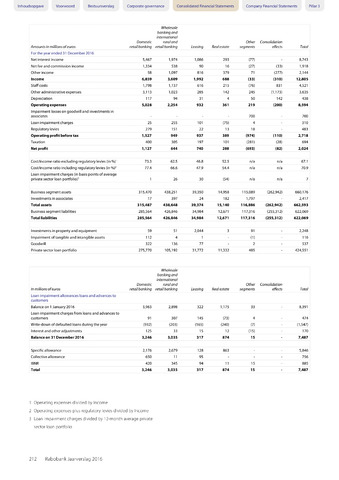

in millions of euros

Domestic

retail banking

Wholesale

banking and

international

rural and

retail banking

Leasing

Real estate

Other

segments

Consolidation

effects

Total

Loan impairment allowances loans and advances to

customers

Balance on 1 January 2016

3,963

2,898

322

1,175

33

8,391

Loan impairment charges from loans and advances to

customers

91

307

145

(73)

4

474

Write-down of defaulted loans during the year

(932)

(203)

(165)

(240)

(7)

(1,547)

Interest and other adjustments

125

33

15

12

(15)

170

Balance on 31 December 2016

3,246

3,035

317

874

15

7,487

Specific allowance

2,176

2,679

128

863

5,846

Collective allowance

650

11

95

756

IBNR

420

345

94

11

15

885

Total

3,246

3,035

317

874

15

7,487

1 Operating expenses divided by Income

2 Operating expenses plus regulatory levies divided by Income

3 Loan impairment charges divided by 12-month average private

sector loan portfolio

212 Rabobank Jaarverslag 2016