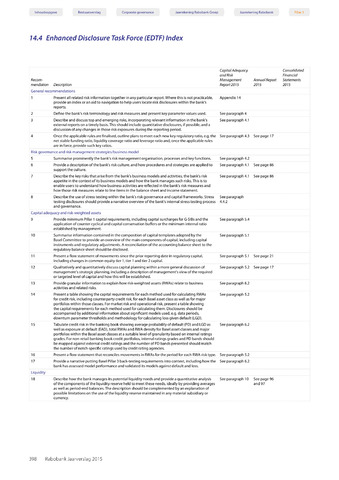

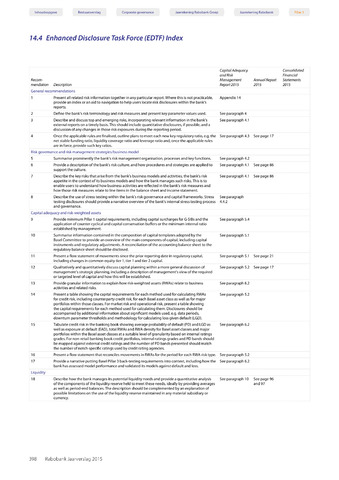

14.4 Enhanced Disclosure Task Force (EDTF) Index

Inhoudsopgave Bestuursverslag Corporate governance Jaarrekening Rabobank Groep Jaarrekening Rabobank

Recom

mendation

Description

Capital Adequacy

and Risk

Management

Report 2015

Consolidated

Financial

Annual Report Statements

2015 2015

General recommendations

1

Present all related risk information together in any particular report. Where this is not practicable,

provide an index or an aid to navigation to help users locate risk disclosures within the bank's

reports.

Appendix 14

2

Define the bank's risk terminology and risk measures and present key parameter values used.

See paragraph 4

3

Describe and discuss top and emerging risks, incorporating relevant information in the bank's

external reports on a timely basis. This should include quantitative disclosures, if possible, and a

discussion of any changes in those risk exposures during the reporting period.

See paragraph 4.1

4

Once the applicable rules are finalised, outline plans to meet each new key regulatory ratio, e.g. the

net stable funding ratio, liquidity coverage ratio and leverage ratio and, once the applicable rules

are in force, provide such key ratios.

See paragraph 4.3

See page 17

Risk governance and risk management strategies/business model

5

Summarise prominently the bank's risk management organisation, processes and key functions.

See paragraph 4.2

6

Provide a description of the bank's risk culture, and how procedures and strategies are applied to

support the culture.

See paragraph 4.1

See page 86

7

Describe the key risks that arise from the bank's business models and activities, the bank's risk

appetite in the context of its business models and how the bank manages such risks. This is to

enable users to understand how business activities are reflected in the bank's risk measures and

how those risk measures relate to line items in the balance sheet and income statement.

See paragraph 4.1

See page 86

8

Describe the use of stress testing within the bank's risk governance and capital frameworks. Stress

testing disclosures should provide a narrative overview of the bank's internal stress testing process

and governance.

See paragraph

4.4.2

Capital adequacy and risk-weighted assets

9

Provide minimum Pillar 1 capital requirements, including capital surcharges for G-SIBs and the

application of counter-cyclical and capital conservation buffers or the minimum internal ratio

established by management.

See paragraph 5.4

10

Summarise information contained in the composition of capital templates adopted by the

Basel Committee to provide an overview of the main components of capital, including capital

instruments and regulatory adjustments. A reconciliation of the accounting balance sheet to the

regulatory balance sheet should be disclosed.

See paragraph 5.1

11

Present a flow statement of movements since the prior reporting date in regulatory capital,

including changes in common equity tier 1tier 1 and tier 2 capital.

See paragraph 5.1

See page 21

12

Qualitatively and quantitatively discuss capital planning within a more general discussion of

management's strategic planning, including a description of management's view of the required

or targeted level of capital and how this will be established.

See paragraph 5.2

See page 17

13

Provide granular information to explain how risk-weighted assets (RWAs) relate to business

activities and related risks.

See paragraph 6.2

14

Present a table showing the capital requirements for each method used for calculating RWAs

for credit risk, including counterparty credit risk, for each Basel asset class as well as for major

portfolios within those classes. For market risk and operational risk, present a table showing

the capital requirements for each method used for calculating them. Disclosures should be

accompanied by additional information about significant models used, e.g. data periods,

downturn parameter thresholds and methodology for calculating loss given default (LGD).

See paragraph 5.2

15

Tabulate credit risk in the banking book showing average probability of default (PD) and LGD as

well as exposure at default (EAD), total RWAs and RWA density for Basel asset classes and major

portfolios within the Basel asset classes at a suitable level of granularity based on internal ratings

grades. For non-retail banking book credit portfolios, internal ratings grades and PD bands should

be mapped against external credit ratings and the number of PD bands presented should match

the number of notch-specific ratings used by credit rating agencies.

See paragraph 6.2

16

Present a flow statement that reconciles movements in RWAs for the period for each RWA risk type.

See paragraph 5.2

17

Provide a narrative putting Basel Pillar 3 back-testing requirements into context, including how the

bank has assessed model performance and validated its models against default and loss.

See paragraph 6.2

Liquidity

18

Describe how the bank manages its potential liquidity needs and provide a quantitative analysis

of the components of the liquidity reserve held to meet these needs, ideally by providing averages

as well as period-end balances. The description should be complemented by an explanation of

possible limitations on the use of the liquidity reserve maintained in any material subsidiary or

currency.

See paragraph 10

See page 96

and 97

398 Rabobank Jaarverslag 2015