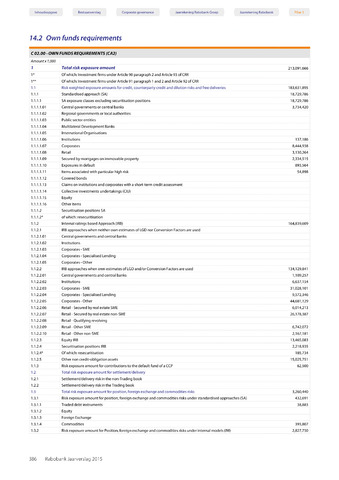

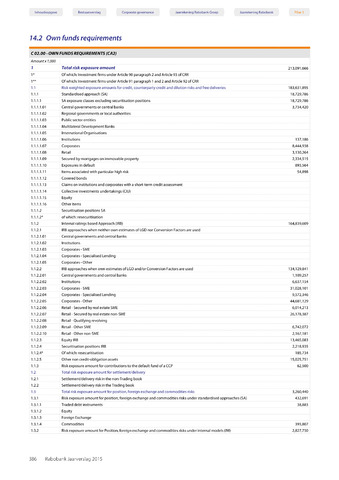

14.2 Own funds requirements

Inhoudsopgave

Bestuursverslag

Corporate governance

Jaarrekening Rabobank Groep

Jaarrekening Rabobank

C 02.00 - OWN FUNDS REQUIREMENTS (CA2)

Amount x 1,000

1

Total risk exposure amount

213,091,666

Of which: Investment firms under Article 90 paragraph 2 and Article 93 of CRR

Of which: Investment firms under Article 91 paragraph 1 and 2 and Article 92 of CRR

Risk weighted exposure amounts for credit, counterparty credit and dilution risks and free deliveries

183,631,895

.1

Standardised approach (SA)

18,729,786

.1.1

SA exposure classes excluding securitisation positions

18,729,786

.1.1.01

Central governments or central banks

3,734,420

.1.1.02

Regional governments or local authorities

.1.1.03

Public sector entities

.1.1.04

Multilateral Development Banks

.1.1.05

International Organisations

.1.1.06

Institutions

137,186

.1.1.07

Corporates

8,444,938

.1.1.08

Retail

3,130,264

.1.1.09

Secured by mortgages on immovable property

2,334,515

.1.1.10

Exposures in default

893,564

.1.1.11

Items associated with particular high risk

54,898

.1.1.12

Covered bonds

.1.1.13

Claims on institutions and corporates with a short-term credit assessment

.1.1.14

Collective investments undertakings (CIU)

.1.1.15

Equity

.1.1.16

Other items

.1.2

Securitisation positions SA

.1.2*

of which: resecuritisation

.2

Internal ratings based Approach (IRB)

164,839,609

.2.1

IRB approaches when neither own estimates of LGD nor Conversion Factors are used

.2.1.01

Central governments and central banks

.2.1.02

Institutions

.2.1.03

Corporates-SME

.2.1.04

Corporates - Specialised Lending

.2.1.05

Corporates - Other

.2.2

IRB approaches when own estimates of LGD and/or Conversion Factors are used

134,129,841

.2.2.01

Central governments and central banks

1,109,257

.2.2.02

Institutions

6,637,154

.2.2.03

Corporates-SME

31,028,101

.2.2.04

Corporates - Specialised Lending

9,572,346

.2.2.05

Corporates - Other

44,681,129

.2.2.06

Retail - Secured by real estate SME

6,014,213

.2.2.07

Retail - Secured by real estate non-SME

26,178,387

.2.2.08

Retail - Qualifying revolving

.2.2.09

Retail-Other SME

6,742,072

.2.2.10

Retail - Other non-SME

2,167,181

.2.3

Equity IRB

13,465,083

.2.4

Securitisation positions IRB

2,218,935

.2.4*

Of which: resecuritisation

185,734

.2.5

Other non credit-obligation assets

15,025,751

.3

Risk exposure amount for contributions to the default fund of a CCP

62,500

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

2

2.1

2.2

3

3.1

3.1.1

3.1.2

3.1.3

3.1.4

3.2

Total risk exposure amount for settlement/delivery

Settlement/delivery risk in the non-Trading book

Settlement/delivery risk in the Trading book

Total risk exposure amount for position, foreign exchange and commodities risks

Risk exposure amount for position, foreign exchange and commodities risks under standardised approaches (SA)

Traded debt instruments

Equity

Foreign Exchange

Commodities

Risk exposure amount for Position, foreign exchange and commodities risks under internal models (IM)

3,260,440

432,691

38,883

393,807

2,827,750

386 Rabobank Jaarverslag 2015