7.5 Risk measurement

Inhoudsopgave

Bestuursverslag

Corporate governance

Jaarrekening Rabobank Groep

Jaarrekening Rabobank

Based on EBA guidelines published in 2014, retained

securitisations are no longer classified as securitisation

exposures where no significant risk transfer has been achieved.

These are reported subsequently based on the underlying

assets. In this context, Rabobank did not securitise exposures

in 2015 that resulted in significant risk transfer. Retained

securitisation exposures also include on and off balance sheet

exposure to the sponsor (Nieuw Amsterdam). Exposures in

the trading book are not related to own asset securitisation

transactions.

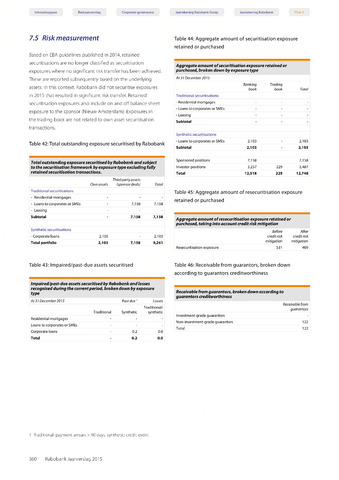

Table 42:Total outstanding exposure securitised by Rabobank

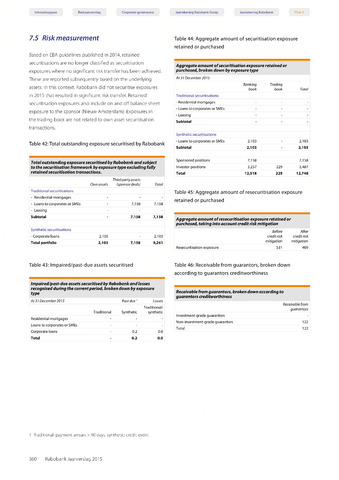

Table 44: Aggregate amount of securitisation exposure

retained or purchased

Aggregate amount of securitisation exposure retained or

purchased, broken down by exposure type

At 31 December 2015

Traditional securitisations

- Residential mortgages

- Loans to corporates or SMEs

- Leasing

Subtotal

Synthetic securitisations

- Loans to corporates or SMEs

Subtotal

Banking

book

2,103

2,103

Trading

book

Total

2,103

2,103

Total outstanding exposure securitised by Rabobank and subject

to the securitisation framework by exposure type excluding fully

retained securitisation transactions.

Traditional securitisations

- Residential mortgages

- Loans to corporates or SMEs

- Leasing

Subtotal

Synthetic securitisations

- Corporate loans

Total portfolio

Third party assets

Own assets (sponsor deals)

7,158

2,103

2,103

7,158

Total

7,158

7,158

2,103

7,158 9,261

Sponsored positions

Investor positions

Total

7,158

3,257

12,518

229

229

7,158

3,487

12,748

Table 45: Aggregate amount of resecuritisation exposure

retained or purchased

Aggregate amount of resecuritisation exposure retained or

purchased, taking into account credit risk mitigation

Resecuritisation exposure

Before After

credit risk credit risk

mitigation mitigation

531 409

Table 43: Impaired/past-due assets securitised

Impaired/past-due assets securitised by Rabobank and losses

recognised during the current period, broken down by exposure

type

At 31 December 2015

Residential mortgages

Loans to corporates or SMEs

Corporate loans

Total

Past due1

Losses

Traditional/

Traditional Synthetic synthetic

0.2

0.2

0.0

0.0

Table 46: Receivable from guarantors, broken down

according to guarantors creditworthiness

Receivable from guarantors, broken down according to

guarantors creditworthiness

Investment-grade guarantors

Non-investment-grade guarantors

Total

Receivable from

guarantors

122

122

1 Traditional: payment arrears 90 days, synthetic: credit event

360 Rabobank Jaarverslag 2015