Inhoudsopgave Bestuursverslag Corporate governance

The policy of Rabobank is aimed at applying the IRB approach

for its credit portfolio as much as possible. A few exceptions

can be made to this policy. The criteria used to assess when

the IRB approach does not need to be applied for a credit

portfolio are included in the 'Policy on partial use of the

Standardised Approach'. In this policy a distinction is made

between portfolios on which the Standardised Approach (SA) is

permanently applied - as they are immaterial in size and risk -

and portfolios for which SA is temporarily applied. Within the

portfolios for which SA is permanently applied, a distinction is

made between portfolios for which the credit risk is nil or very

limited (e.g. some central governments) and portfolios falling

under discretionary approval of DNB for using the SA, for which

specific limits are prescribed.

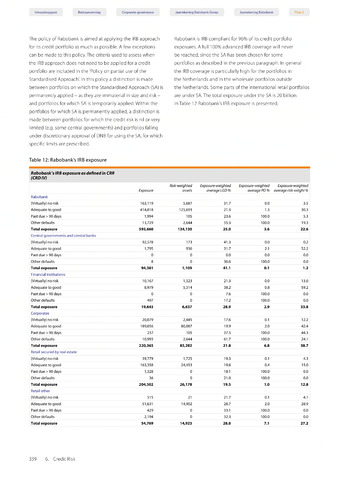

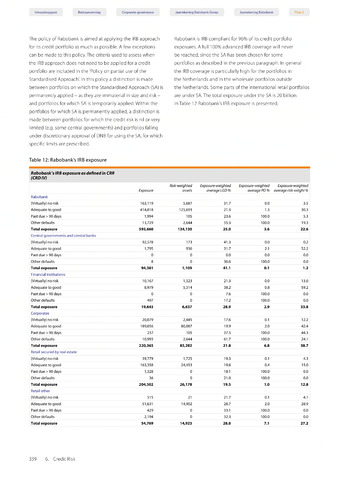

Table 12: Rabobank's IRB exposure

Jaarrekening Rabobank Groep Jaarrekening Rabobank

Rabobank is IRB compliant for 96% of its credit portfolio

exposures. A full 100% advanced IRB coverage will never

be reached, since the SA has been chosen for some

portfolios as described in the previous paragraph. In general

the IRB coverage is particularly high for the portfolios in

the Netherlands and in the wholesale portfolios outside

the Netherlands. Some parts of the international retail portfolios

are under SA.The total exposure under the SA is 20 billion.

In Table 12 Rabobank's IRB exposure is presented.

Rabobank's IRB exposure as defined in CRR

(CRD IV)

Exposure

Risk-weighted

assets

Exposure-weighted

average LQD

Exposure-weigh ted

average PD

Exposure-weighted

average risk weight

Rabobank

(Virtually) no risk

163,119

5,687

31.7

0.0

3.5

Adequate to good

414,818

125,693

21.3

1.3

30.3

Past due 90 days

1,994

105

23.6

100.0

5.3

Other defaults

13,729

2,644

55.3

100.0

19.3

Total exposure

593,660

134,130

25.0

3.6

22.6

Central governments and central banks

(Virtually) no risk

92,578

173

41.3

0.0

0.2

Adequate to good

1,795

936

31.7

2.1

52.2

Past due >90 days

0

0

0.0

0.0

0.0

Other defaults

8

0

36.6

100.0

0.0

Total exposure

94,381

1,109

41.1

0.1

1.2

Financial institutions

(Virtually) no risk

10,167

1,323

21.3

0.0

13.0

Adequate to good

8,979

5,314

38.2

0.8

59.2

Past due >90 days

0

0

7.6

100.0

0.0

Other defaults

497

0

17.2

100.0

0.0

Total exposure

19,643

6,637

28.9

2.9

33.8

Corporates

(Virtually) no risk

20,079

2,445

17.6

0.1

12.2

Adequate to good

189,056

80,087

19.9

2.0

42.4

Past due 90 days

237

105

37.5

100.0

44.3

Other defaults

10,993

2,644

61.7

100.0

24.1

Total exposure

220,365

85,282

21.8

6.8

38.7

Retail secured by real estate

(Virtually) no risk

39,779

1,725

19.3

0.1

4.3

Adequate to good

163,358

24,453

19.6

0.4

15.0

Past due 90 days

1,328

0

18.1

100.0

0.0

Other defaults

36

0

21.0

100.0

0.0

Total exposure

204,502

26,178

19.5

1.0

12.8

Retail other

(Virtually) no risk

515

21

21.7

0.1

4.1

Adequate to good

51,631

14,902

28.7

2.0

28.9

Past due 90 days

429

0

33.1

100.0

0.0

Other defaults

2,194

0

32.3

100.0

0.0

Total exposure

54,769

14,923

28.8

7.1

27.2

339 6. Credit Risk