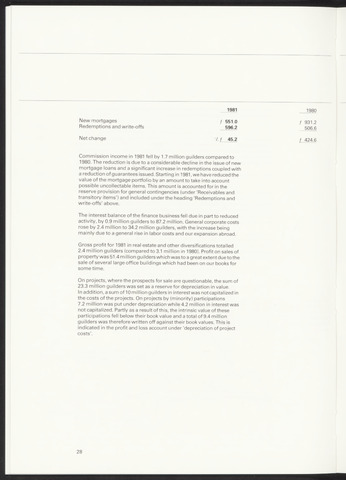

1981

1980

New mortgages 551.0 931.2

Redemptions and write-offs 596.2 506.6

Net change 45.2 f 424.6

Commission income in 1981 fell by 1.7 million guilders compared to

1980. The reduction is due to a considerable decline in the issue of new

mortgage loans and a significant increase in redemptions coupled with

a reduction of guarantees issued. Starting in 1981we have reduced the

value of the mortgage portfolio by an amount to take into account

possible uncollectable items. This amount is accounted for in the

reserve provision for general contingencies (under 'Receivables and

transitory items') and included under the heading 'Redemptions and

write-offs' above.

The interest balance of the finance business fell due in part to reduced

activity, by 0.9 million guilders to 87.2 million. General corporate costs

rose by 2.4 million to 34.2 million guilders, with the increase being

mainly due to a general rise in labor costs and our expansion abroad.

Gross profit for 1981 in real estate and other diversifications totalled

2.4 million guilders (compared to 3.1 million in 1980). Profit on sales of

property was 51.4 million guilders which was to a great extent due to the

sale of several large office buildings which had been on our books for

sometime.

On projects, where the prospects for sale are questionable, the sum of

23.3 million guilders was set as a reserve for depreciation in value.

In addition, a sum of 10 million guilders in interest was not capitalized in

the costs of the projects. On projects by (minority) participations

7.2 million was put under depreciation while 4.2 million in interest was

not capitalized. Partly as a result of this, the intrinsic value of these

participations fell below their book value and a total of 9.4 million

guilders was therefore written off against their book values. This is

indicated in the profit and loss account under 'depreciation of project

costs'.

28