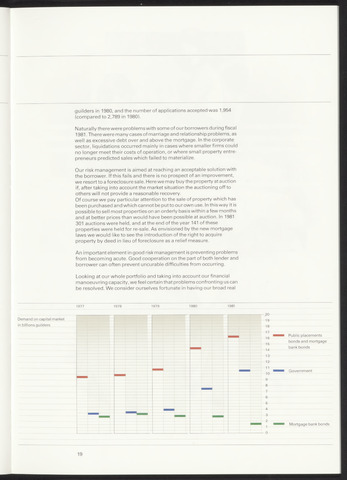

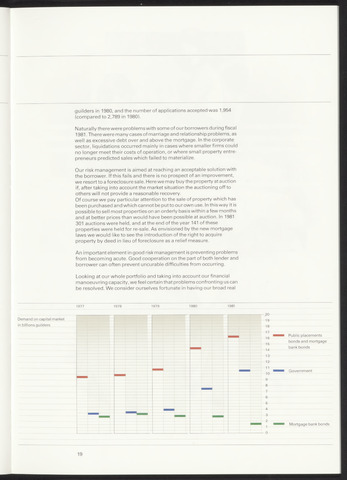

Demand on capital market

in billions guilders

guilders in 1980, and the number of applications accepted was 1,954

(compared to 2,789 in 1980).

Naturally there were problems with some of our borrowers during fiscal

1981There were many cases of marriage and relationship problems, as

well as excessive debt over and above the mortgage. In the corporate

sector, liquidations occurred mainly in cases where smaller firms could

no longer meet their costs of operation, or where small property entre

preneurs predicted sales which failed to materialize.

Our risk management is aimed at reaching an acceptable solution with

the borrower. If this fails and there is no prospect of an improvement,

we resort to a foreclosure sale. Here we may buy the property at auction

if, after taking into account the market situation the auctioning off to

others will not provide a reasonable recovery.

Of course we pay particular attention to the sale of property which has

been purchased and which cannot be putto our own use. In this way it is

possible to sell most properties on an orderly basis within a few months

and at better prices than would have been possible at auction. In 1981

301 auctions were held, and at the end of the year 141 of these

properties were held for re-sale. As envisioned by the new mortgage

laws we would like to seethe introduction of the right to acquire

property by deed in lieu of foreclosure as a relief measure.

An important element in good risk management is preventing problems

from becoming acute. Good cooperation on the part of both lender and

borrower can often prevent uncurable difficulties from occurring.

Looking at our whole portfolio and taking into account our financial

manoeuvring capacity, we feel certain that problems confronting us can

be resolved. We consider ourselves fortunate in having our broad real

Public placements

bonds and mortgage

bank bonds

Government

Mortgage bank bonds

19