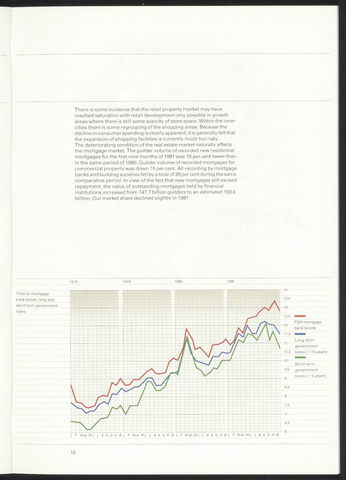

Yield on mortgage

bank bonds, long and

shortterm government

loans

There is some evidence that the retail property market may have

reached saturation with retail development only possible in growth

areas where there is still some scarcity of store space. Within the inner

cities there is some regrouping of the shopping areas. Because the

decline in consumer spending is clearly apparent, it is generally felt that

the expansion of shopping facilities is currently much too risky.

The deteriorating condition of the real estate market naturally affects

the mortgage market. The guilder volume of recorded new residential

mortgages for the first nine months of 1981 was 19 per cent lowerthan

in the same period of 1980. Guilder volume of recorded mortgages for

commercial property was down 15 per cent. All recording by mortgage

banks and building societies fell by a total of 39 per cent during the same

comparative period. In view of the fact that new mortgages still exceed

repayment, the value of outstanding mortgages held by financial

institutions increased from 147.7 billion guilders to an estimated 159.6

billion. Our market share declined slightly in 1981.

1978

1979

1980

1981

FGH mortgage

bank bonds

Long term

government

10.5 loans 10 years)

Shortterm

government

loans 5 years)

j f ma mj j a s o n d j f ma mj j a s o n d j f ma mj j a s o n d j f ma mj j a s o n d

15