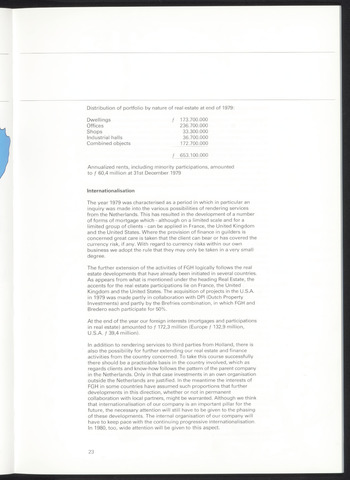

Distribution of portfolio by nature of real estate at end of 1979:

Dwellings

Offices

Shops

Industrial halls

Combined objects

173.700,000

236.700.000

33.300.000

36.700.000

172.700.000

653.100.000

Annualized rents, including minority participations, amounted

to 60,4 million at 31st December 1979

Internationalisation

The year 1979 was characterised as a period in which in particular an

inquiry was made into the various possibilities of rendering services

from the Netherlands. This has resulted in the development of a number

of forms of mortgage which - although on a limited scale and for a

limited group of clients - can be applied in France, the United Kingdom

and the United States. Where the provision of finance in guilders is

concerned great care is taken that the client can bear or has covered the

currency risk, if any. With regard to currency risks within our own

business we adopt the rule that they may only be taken in a very small

degree.

The further extension of the activities of FGH logically follows the real

estate developments that have already been initiated in several countries.

As appears from what is mentioned under the heading Real Estate, the

accents for the real estate participations lie on France, the United

Kingdom and the United States. The acquisition of projects in the U.S.A.

in 1979 was made partly in collaboration with DPI (Dutch Property

Investments) and partly by the Brefries combination, in which FGH and

Bredero each participate for 50%.

At the end of the year our foreign interests (mortgages and participations

in real estate) amounted to 172,3 million (Europe 132,9 million,

U.S.A. 39,4 million).

In addition to rendering services to third parties from Holland, there is

also the possibility for further extending our real estate and finance

activities from the country concerned. To take this course successfully

there should be a practicable basis in the country involved, which as

regards clients and know-how follows the pattern of the parent company

in the Netherlands. Only in that case investments in an own organisation

outside the Netherlands are justified. In the meantime the interests of

FGH in some countries have assumed such proportions that further

developments in this direction, whether or not in permanent

collaboration with local partners, might be warranted. Although we think

that internationalisation of our company is an important pillar for the

future, the necessary attention will still have to be given to the phasing

of these developments. The internal organisation of our company will

have to keep pace with the continuing progressive internationalisation.

In 1980, too, wide attention will be given to this aspect.

23