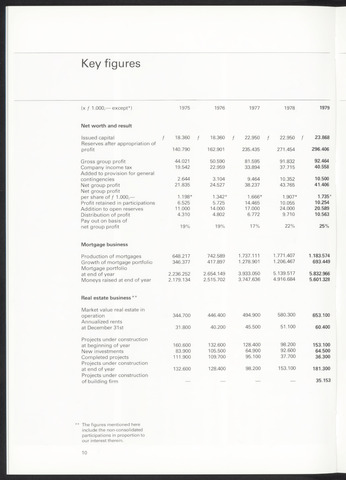

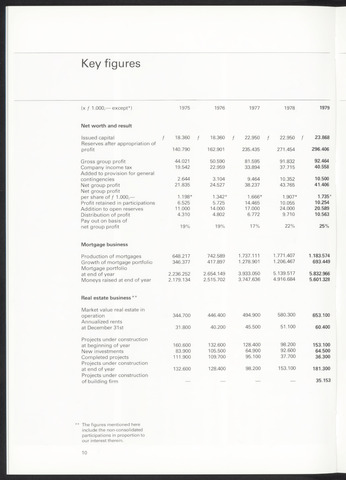

Key figures

(x 1.000,except*)

1975

1976

1977

1978

1979

Net worth and result

Issued capital

Reserves after appropriation of

18.360

f 18.360

f 22.950

f 22.950

23.868

profit

140.790

162.901

235.435

271.454

296.406

Gross group profit

44.021

50.590

81.595

91.832

92.464

Company income tax

Added to provision for general

19.542

22.959

33.894

37.715

40.558

contingencies

2.644

3.104

9.464

10.352

10.500

Net group profit

Net group profit

21.835

24.527

38.237

43.765

41.406

per share of 1.000,

1.198*

1.342*

1.666*

1.907*

1.735*

Profit retained in participations

6.525

5.725

14.465

10.055

10.254

Addition to open reserves

11.000

14.000

17.000

24.000

20.589

Distribution of profit

Pay out on basis of

4.310

4.802

6.772

9.710

10.563

net group profit

19%

19%

17%

22%

25%

Mortgage business

Production of mortgages

648.217

742.589

1.737.111

1.771.407

1.183.574

Growth of mortgage portfolio

Mortgage portfolio

346.377

417.897

1.278.901

1.206.467

693.449

at end of year

2.236.252

2.654.149

3.933.050

5.139.517

5.832.966

Moneys raised at end of year

Real estate business**

2.179.134

2.515.702

3.747.636

4.916.684

5.601.328

Market value real estate in

operation

Annualized rents

344.700

446.400

494.900

580.300

653.100

at December 31st

31.800

40.200

45.500

51.100

60.400

Projects under construction

at beginning of year

160.600

132.600

128.400

98.200

153.100

New investments

83.900

105.500

64.900

92.600

64.500

Completed projects

Projects under construction

111.900

109.700

95.100

37.700

36.300

at end of year

Projects under construction

132.600

128.400

98.200

153.100

181.300

of building firm

35.153

The figures mentioned here

include the non-consolidated

participations in proportion to

our interest therein.

10