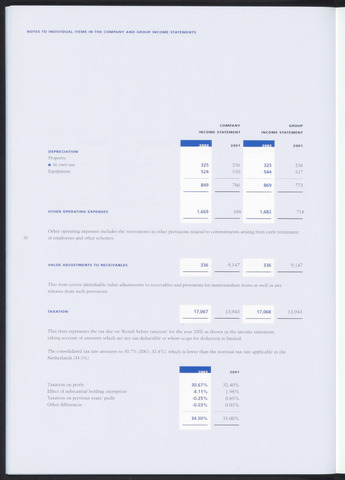

DEPRECIATION

Property:

in own use

Equipment

COMPANY

INCOME STATEMENT

GROUP

INCOME STATEMENT

325 256 325 256

524 510 544 517

849 766 869 773

OTHER OPERATING EXPENSES

1,669 588 1,682 718

Other operating expenses includes the movements in other provisions related to commitments arising from early retirement

30 of employees and other schemes.

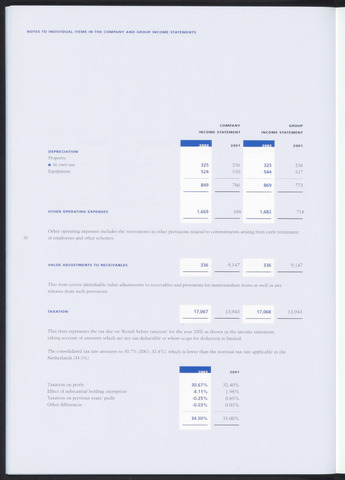

VALUE ADJUSTMENTS TO RECEIVABLES 336 9,147 336 9,147

This item covers identifiable value adjustments to receivables and provisions for memorandum items as well as any

releases from such provisions.

taxation 17,067 13,943 17,068 13,943

This item represents the tax due on 'Result before taxation' for the year 2002 as shown in the income statement,

taking account of amounts which are not tax-deductible or where scope for deduction is limited.

The consolidated tax rate amounts to 30.7% (2001: 32.4%), which is lower than the nominal tax rate applicable in the

Netherlands (34.5%).

2001

Taxation on profit

30.67%

32.40%

Effect of substantial holding exemption

4.11%

1.98%

Taxation on previous years' profit

-0.25%

0.65%

Other differences

-0.03%

-0.03%

34.50% 35.00%