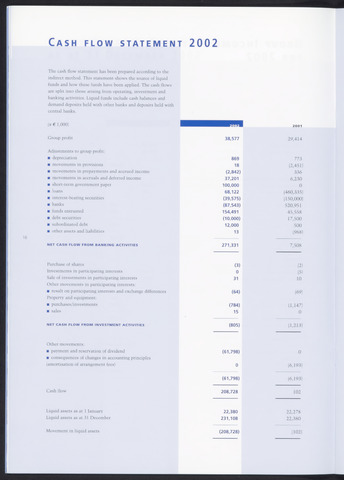

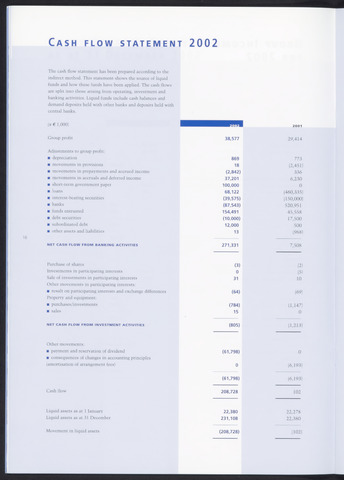

Cash flow statement 2002

The cash flow statement has been prepared according to the

indirect method. This statement shows the source of liquid

funds and how these funds have been applied. The cash flows

are split into those arising from operating, investment and

banking activities. Liquid funds include cash balances and

demand deposits held with other banks and deposits held with

central banks.

(x 1,000)

2001

Group profit

38,577

29,414

Adjustments to group profit:

depreciation

869

773

movements in provisions

18

(2,451)

movements in prepayments and accrued income

(2,842)

336

movements in accruals and deferred income

37,201

6,230

short-term government paper

100,000

0

loans

68,122

(460,335)

interest-bearing securities

(39,575)

(150,000)

banks

(87,543)

520,951

funds entrusted

154,491

45,558

debt securities

(10,000)

17,500

subordinated debt

12,000

500

other assets and liabilities

13

(968)

NET CASH FLOW FROM BANKING ACTIVITIES

271,331

7)508

Purchase of shares

(3)

(2)

Investments in participating interests

0

(5)

Sale of investments in participating interests

Other movements in participating interests:

31

10

result on participating interests and exchange differences

Property and equipment:

(64)

(69)

purchases/investments

(784)

(1,147)

sales

15

0

NET CASH FLOW FROM INVESTMENT ACTIVITIES

(805)

(1,213)

Other movements:

payment and reservation of dividend

consequences of changes in accounting principles

(61,798)

0

(amortisation of arrangement fees)

0

(6,193)

(61,798)

(6,193)

Cash flow

208,728

102

Liquid assets as at 1 January

22,380

22,278

Liquid assets as at 31 December

231,108

22,380

Movement in liquid assets

(208,728)

(102)